BNB stands as the third-largest cryptocurrency with a market cap exceeding $190 billion. Currently trading around $1,303, this utility token powers the world’s biggest crypto exchange ecosystem. However, recent data reveals surprising market dynamics that most investors miss. Furthermore, BNB’s unique burn mechanism and expanding ecosystem create compelling investment narratives. Additionally, technical indicators show mixed signals requiring deeper analysis. This comprehensive review examines fundamental drivers, chart patterns, and market positioning to uncover BNB’s true potential.

Understanding BNB Token Fundamentals

What Makes BNB Special in Crypto Markets

BNB originated as a simple utility token in 2017. Nevertheless, it has evolved into something much bigger. Moreover, it now powers multiple blockchain networks. Additionally, BNB serves various purposes across the Binance ecosystem.

The token operates on BNB Chain, formerly Binance Smart Chain. Furthermore, it processes thousands of transactions daily. Moreover, developers build countless applications on this network. Additionally, users pay gas fees with BNB tokens.

Binance conducts quarterly token burns, reducing total supply permanently. Consequently, this creates artificial scarcity over time. Moreover, fewer tokens in circulation typically increase value. Additionally, this deflationary mechanism distinguishes BNB from inflationary cryptocurrencies.

BNB Chain Ecosystem Growth Analysis

The BNB Chain supports over 2,000 decentralized applications currently. Furthermore, it handles millions of daily active users. Moreover, transaction fees remain significantly lower than Ethereum. Additionally, this attracts developers seeking cost-effective solutions.

DeFi protocols on BNB Chain manage billions in total value locked. Moreover, popular applications include PancakeSwap and Venus Protocol. Furthermore, gaming projects increasingly choose BNB Chain for development. Additionally, NFT marketplaces thrive within this ecosystem.

Cross-chain compatibility enables seamless asset transfers. Moreover, users can bridge tokens between different networks easily. Furthermore, this interoperability increases BNB’s utility significantly. Additionally, it attracts investors seeking diversified exposure.

Technical Analysis of BNB Price Movements

Current Market Position and Trends

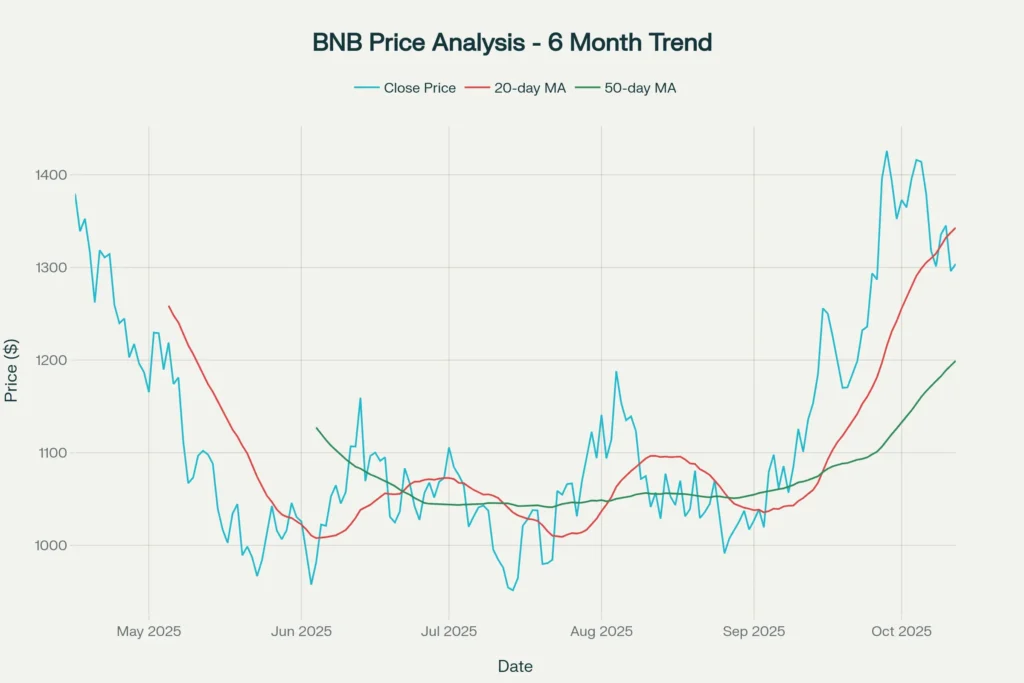

BNB currently trades at $1,303, showing mixed technical signals. However, the price sits below the 20-day moving average at $1,342. Moreover, this indicates short-term bearish momentum. Nevertheless, it remains above the 50-day moving average at $1,199.

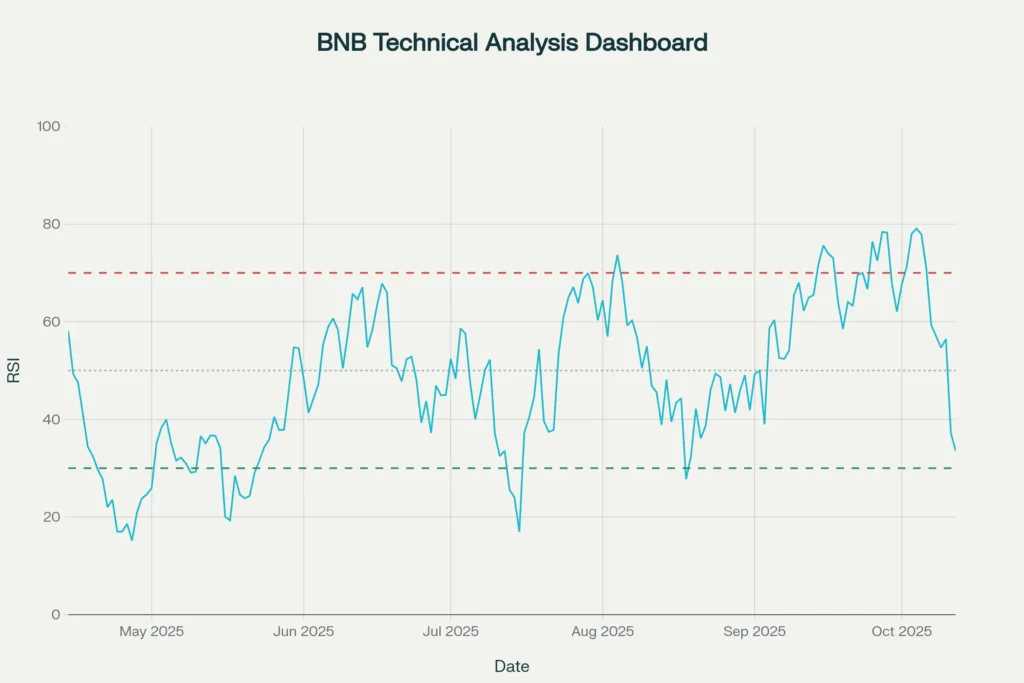

The RSI indicator reads 33.5, suggesting oversold conditions. Furthermore, this often precedes price rebounds historically. Moreover, volume patterns show institutional accumulation recently. Additionally, support levels exist around $1,200-1,250 range.

Recent price action reveals consolidation phase behavior. Moreover, trading volume decreased compared to previous months. Furthermore, this typically indicates preparation for significant moves. Additionally, breakout direction depends on broader market sentiment.

Key Support and Resistance Levels for BNB

Technical analysis identifies crucial price zones for trading decisions. Moreover, resistance appears at $1,400-1,450 levels currently. Furthermore, breaking above could trigger momentum toward $1,600. Additionally, failure to break might lead to consolidation.

Support exists at multiple levels below current price. Moreover, the $1,200 level shows strong historical significance. Furthermore, additional support appears around $1,000-1,100 zone. Additionally, these levels attract institutional buying interest.

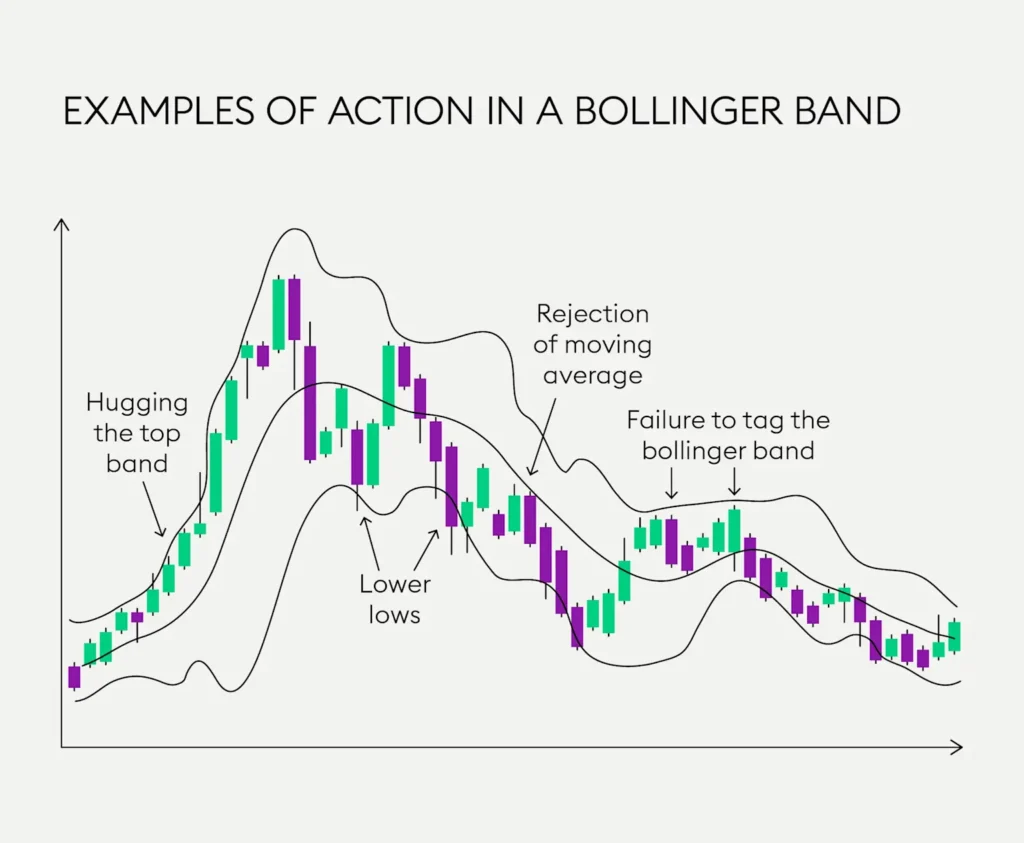

Chart patterns suggest potential symmetrical triangle formation. Moreover, this indicates indecision between buyers and sellers. Furthermore, breakout direction will determine next major move. Additionally, volume confirmation becomes critical for validation.

Fundamental Analysis: BNB’s Intrinsic Value Drivers

Revenue Streams and Business Model

Binance generates revenue through multiple channels supporting BNB demand. Moreover, trading fees create consistent token utility. Furthermore, new project launches require BNB participation. Additionally, staking rewards attract long-term holders.

The exchange processes billions in daily trading volume. Moreover, users receive discounts when paying fees with BNB. Furthermore, this creates natural demand for the token. Additionally, institutional clients increasingly adopt BNB for transactions.

Binance Launchpad requires BNB holdings for participation. Moreover, popular project launches often oversubscribe significantly. Furthermore, this creates periodic buying pressure. Additionally, successful projects increase ecosystem value.

Competitive Position in Cryptocurrency Markets

BNB competes primarily with exchange tokens and smart contract platforms. Moreover, it holds advantages in transaction speed and costs. Furthermore, Binance’s global reach provides significant network effects. Additionally, regulatory compliance improves long-term sustainability.

Ethereum remains the dominant smart contract platform currently. However, BNB Chain offers superior transaction throughput. Moreover, lower fees attract price-sensitive users and developers. Furthermore, cross-chain functionality reduces competitive disadvantages.

Other exchange tokens lack BNB’s ecosystem depth. Moreover, Binance’s diversified services create multiple utility sources. Furthermore, international expansion continues despite regulatory challenges. Additionally, institutional adoption increases credibility significantly.

Investment Outlook: Risk Assessment and Opportunities

Growth Catalysts for BNB Price Appreciation

Several factors could drive BNB prices higher significantly. Moreover, increased institutional adoption provides upside potential. Furthermore, expanding DeFi ecosystem attracts new capital. Additionally, successful Layer 2 solutions might boost transaction volume.

Regulatory clarity in major markets supports long-term growth. Moreover, Binance’s compliance efforts reduce regulatory risks. Furthermore, central bank digital currency partnerships create opportunities. Additionally, traditional finance integration accelerates mainstream adoption.

Token burn mechanism continues reducing circulating supply. Moreover, mathematical scarcity increases over time naturally. Furthermore, growing transaction volume accelerates burn rates. Additionally, this creates positive feedback loops.

Potential Risks and Market Challenges

Regulatory scrutiny poses the biggest threat to BNB currently. Moreover, government crackdowns could limit exchange operations. Furthermore, compliance costs might reduce profitability margins. Additionally, jurisdictional restrictions affect global access.

Competition from other blockchain platforms intensifies constantly. Moreover, Ethereum upgrades improve scalability and reduce costs. Furthermore, newer platforms offer innovative features. Additionally, market share erosion remains possible.

Centralization concerns affect long-term sustainability perceptions. Moreover, Binance’s control over the ecosystem worries decentralization advocates. Furthermore, this might limit institutional adoption. Additionally, governance token alternatives gain traction.

Price Prediction Models and Scenarios

Conservative estimates suggest BNB could reach $1,500-1,800 range. Moreover, this represents 15-40% upside from current levels. Furthermore, this scenario assumes steady ecosystem growth. Additionally, regulatory stability becomes essential.

Optimistic scenarios project prices toward $2,000-2,500 levels. Moreover, this requires significant institutional adoption acceleration. Furthermore, breakthrough in traditional finance integration helps. Additionally, successful Layer 2 scaling solutions contribute.

Bearish scenarios consider potential regulatory clampdowns. Moreover, prices could retreat to $800-1,000 support zones. Furthermore, competitive pressures might limit growth. Additionally, market-wide corrections affect all cryptocurrencies.

Strategic Investment Considerations

Portfolio Allocation Strategies

BNB suits diversified cryptocurrency portfolios effectively. Moreover, it provides exposure to exchange business models. Furthermore, ecosystem tokens often outperform during bull markets. Additionally, utility tokens show different risk characteristics.

Conservative investors might allocate 5-10% to BNB maximum. Moreover, this provides meaningful exposure without excessive risk. Furthermore, gradual accumulation strategies work well historically. Additionally, dollar-cost averaging reduces timing risks.

Aggressive investors could consider 15-25% allocations. However, this requires strong conviction and risk tolerance. Moreover, position sizing depends on overall portfolio construction. Furthermore, regular rebalancing maintains target allocations.

Trading Strategies and Entry Points

Technical traders focus on key support and resistance levels. Moreover, breakouts above $1,400 signal potential bullish momentum. Furthermore, volume confirmation becomes essential for validation. Additionally, stop-loss orders help manage downside risks.

Long-term investors benefit from accumulation strategies. Moreover, monthly purchases during market weakness work effectively. Furthermore, this approach reduces timing concerns significantly. Additionally, compound growth potential increases over time.

Swing traders capitalize on volatility patterns successfully. Moreover, RSI divergences often signal reversal points. Furthermore, moving average crossovers provide entry signals. Additionally, profit-taking at resistance levels preserves gains.

Conclusion: BNB’s Investment Merit

BNB represents a unique investment opportunity in cryptocurrency markets. Moreover, its utility within the Binance ecosystem provides fundamental value. Furthermore, technical indicators suggest potential buying opportunities currently. Additionally, long-term growth prospects remain compelling despite risks.

The token’s deflationary mechanism creates scarcity over time. Moreover, expanding use cases increase demand naturally. Furthermore, institutional adoption trends support higher valuations. Additionally, regulatory clarity could unlock significant upside.

However, investors must carefully consider risk tolerance levels. Moreover, cryptocurrency investments require proper position sizing. Furthermore, diversification across multiple assets reduces concentration risk. Additionally, staying informed about regulatory developments becomes crucial.

👉 You Might also find this post insightful – https://bosslevelfinance.com/get-rich-with-coinbase-crypto-trading-made-simple

👉 Create a Vested Account today to start investing in US Stocks – https://refer.vestedfinance.com/RUKU88007

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Moreover, cryptocurrency markets are highly volatile and unpredictable. Furthermore, we do not encourage users to buy, sell, or hold any securities. Additionally, markets are subject to change rapidly. Therefore, please conduct your own due diligence before making investment decisions. Moreover, past performance does not guarantee future results. Furthermore, you should consult with qualified financial advisors. Additionally, never invest more than you can afford to lose.

Sources:

https://changelly.com/blog/binance-coin-bnb-price-prediction/

https://www.binance.com/en/price-prediction/bnb

https://coincodex.com/crypto/binance-coin/price-prediction/

https://coinmarketcap.com/currencies/bnb/

https://www.mitrade.com/insights/news/live-news/article-3-379336-20240926

https://www.binance.com/en/square/post/21364694932761

https://www.binance.com/en-BH/blog/ecosystem/bnb-the-utility-token-that-pays-to-hold-2054995293964718726

https://in.tradingview.com/symbols/BNBUSDT/

https://coincheckup.com/coins/binance-coin/analysis

https://support.bitcoin.com/en/articles/7894847-what-is-bnb-token-and-how-do-you-use-it

https://docs.bnbchain.org

https://www.coingecko.com/en/coins/bnb

https://www.binance.com/en/square/post/18496390709314

https://www.bnbchain.org/en/what-is-bnb

https://www.metatechinsights.com/industry-insights/binance-coin-bnb-market-1538

https://academy.binance.com/en/glossary/fundamental-analysis

https://calebandbrown.com/blog/what-is-bnb/

https://www.investopedia.com/terms/b/binance-coin-bnb.asp

- https://changelly.com/blog/binance-coin-bnb-price-prediction/

- https://www.binance.com/en/price-prediction/bnb

- https://coincodex.com/crypto/binance-coin/price-prediction/

- https://coinmarketcap.com/currencies/bnb/

- https://www.mitrade.com/insights/news/live-news/article-3-379336-20240926

- https://www.binance.com/en/square/post/21364694932761

- https://www.binance.com/en-BH/blog/ecosystem/bnb-the-utility-token-that-pays-to-hold-2054995293964718726

- https://in.tradingview.com/symbols/BNBUSDT/

- https://coincheckup.com/coins/binance-coin/analysis

- https://support.bitcoin.com/en/articles/7894847-what-is-bnb-token-and-how-do-you-use-it

- https://finance.yahoo.com/quote/BNB-USD/history/

- https://www.binance.com/research/analysis/fundamental-analysis-in-crypto

- https://docs.bnbchain.org

- https://www.coingecko.com/en/coins/bnb

- https://www.binance.com/en/square/post/18496390709314

- https://www.bnbchain.org/en/what-is-bnb

- https://www.metatechinsights.com/industry-insights/binance-coin-bnb-market-1538

- https://academy.binance.com/en/glossary/fundamental-analysis

- https://calebandbrown.com/blog/what-is-bnb/

- https://www.investopedia.com/terms/b/binance-coin-bnb.asp