Asian Paints has evolved from a modest Bombay paint shop in 1942 into one of Asia’s boldest coatings giants. Even though its share price has slipped this year, the company’s cash-rich model, sticky dealer network, and ever-expanding home-decor ecosystem keep it firmly in the limelight. This deep-dive unpacks the numbers, explains the strategy, and highlights what long-term investors should really watch.

Asian Paints Stock Snapshot

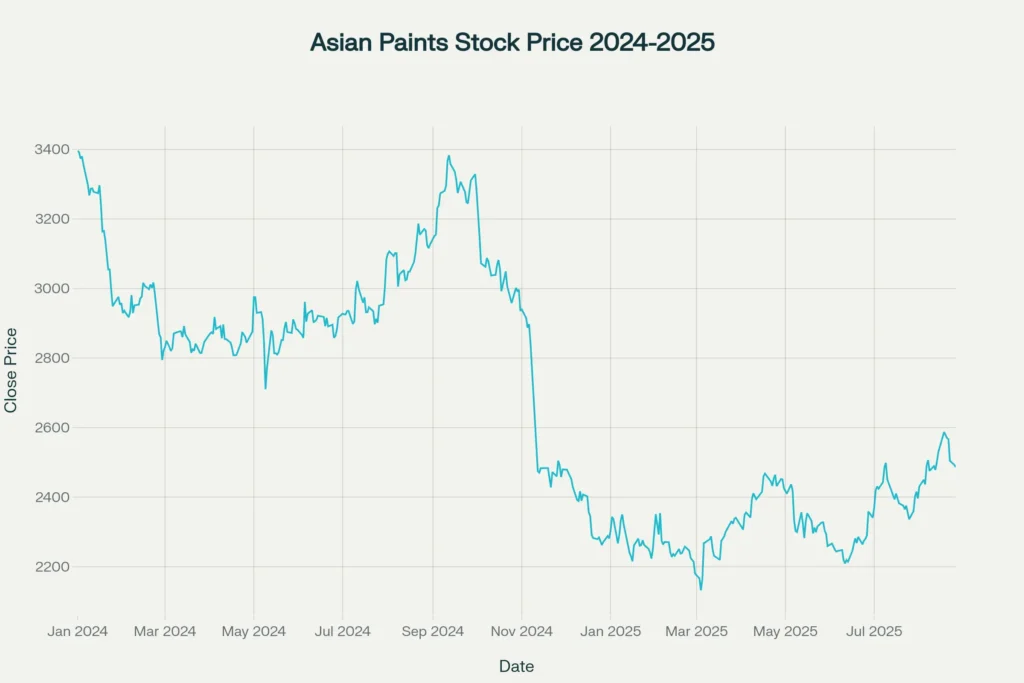

From January 2024 to August 2025, Asian Paints’ share price fell roughly 27 percent as rising input costs and a broader small-cap sell-off hit sentiment. Yet, average daily volatility hovered near one percent, showing resilient institutional support.

Why the Slide Looks Manageable

- Long-term return on equity still tops 25 percent, far above India’s benchmark indices.

- Paint demand remains linked to housing starts, which continue to grow as urbanisation pushes forward.

- Management guided for margin rebuild via premium mixes and cost passes, soothing fears about sustained erosion.

Asian Paints Revenue Rivers

Asian Paints’ FY 2025 sales dipped slightly after a four-year surge, mainly due to a high inflation base. However, gross margins stayed above 42 percent, while operating cash flow exceeded ₹6,000 crore. International subsidiaries now contribute 12 percent of consolidated revenue, dampening local slowdowns.

A Mix That Matters

Because premium interior emulsions and waterproofing products carry thicker margins, the firm has nudged dealers to upsell through colour-visualiser apps and decor studios. Consequently, premium SKU share climbed to 55 percent last year, up from 48 percent in FY 2021.

Cost Discipline and Cash Power

Asian Paints benefits from backward integration into resins, packaging, and even captive power. Although titanium-dioxide prices spiked, raw-material cost as a share of sales still fell two percentage points versus FY 2023. Simultaneously, a just-in-time distribution model slices warehousing costs.

Capital Allocation Clarity

Management targets a pay-out ratio of 40 percent and invests balance cash in capacity, décor acquisitions, and digital tools. Debt-to-equity remains under 0.1 — a fortress balance sheet that supports steady dividend growth without restricting expansion.

Asian Paints’ Dealer Deep Moat

With 75,000+ tinting machines spread nationwide, Asian Paints reaches even remote districts overnight. Dealers earn higher margins on the company’s products than on rivals’, so they naturally push the brand. Moreover, an exclusive shade library keeps comparisons at bay, reinforcing loyalty.

Beyond Paint — The Décor Ecosystem

Asian Paints no longer labels itself just a coatings company. It now sells waterproofing membranes, kitchen cabinetry, bath fittings, lighting, and even soft furnishings under its “Beautiful Homes” initiative. By locking customers into full-service décor contracts, the firm lengthens revenue per household and builds annuity-style income through maintenance packages.

Why This Pivot Adds Value

Because décor buying cycles are longer than repaint cycles, Asian Paints captures deeper customer data, enabling targeted upsells during renovation moments. Additionally, multi-category offerings smooth quarterly earnings blips tied to monsoon repaint seasonality.

Competition and Key Risks

Still, Berger, Kansai Nerolac, and JSW Paints intensify discounting in mass segments. At the same time, Grasim’s Aditya Birla Paints will add fresh capacity by FY 2026, testing dealer loyalty. Hence, Asian Paints must:

- Sustain premium innovation to defend ASPs.

- Expand service differentiation beyond mere colour.

- Protect margins through efficient raw-material sourcing.

Valuation Perspective

Even after the correction, Asian Paints trades near 66 times trailing earnings. High? Yes. Yet, the premium largely reflects unrivalled brand strength, cash efficiency, and predictable growth. Discounting such a moat often proves costly; however, fresh entries could compress multiples if volume share slips.

What to Watch Next

- Input-cost inflation — Crude and TiO2 movements directly sway margins.

- Dealer Exit Barriers — Track tinting machine additions versus rival swaps.

- Décor Studio Ramp-up — More stores signal success in non-paint categories.

- International Scaling — GCC and African plants can add hard-currency profits.

Final Thoughts

Even though the share price has cooled, Asian Paints still mixes vibrant strategy with disciplined finance. Its deep dealer moat, premium pivot, and decor ecosystem together craft a colourful future. Patience may reward investors who appreciate durable competitive shades over short-term market brush-offs.

You Might also find this post insightful – https://bosslevelfinance.com/hdfc-amcs-edge-brand-flows-profit

Disclaimer: This post is purely educational. It is not a recommendation to buy, sell, or hold any security. Stock markets are volatile; please conduct your own due diligence before investing.

Source Links

NSE price history and market data

Asian Paints annual reports and investor presentations

Ministry of Housing construction statistics

Industry reports on Indian decorative paints market

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/b67f0f6107d073e07f9b80adae020abf/9cba377b-8f6a-40db-b613-d191603d8a78/ef5f1959.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/b67f0f6107d073e07f9b80adae020abf/9cba377b-8f6a-40db-b613-d191603d8a78/a9a79c81.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/b67f0f6107d073e07f9b80adae020abf/a3cb9623-914f-49cb-9bce-ea8523db6298/6114d1ca.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/b67f0f6107d073e07f9b80adae020abf/a3cb9623-914f-49cb-9bce-ea8523db6298/2bf51a25.csv