Are you curious about whether Tesla remains a solid investment opportunity in late 2025? In this detailed, easy-to-understand blog, we’ll break down Tesla’s recent results, highlight potential risks, and give you actionable insights. Whether you’re a new investor or a seasoned trader, this full analysis cuts through the hype with facts, real numbers, and approachable language.

Disclaimer: This article is for analysis only and does not recommend buying, selling, or holding any securities. Stock markets are unpredictable. Please do your own research before making decisions.

Tesla at a Glance: Incredible Growth, New Challenges

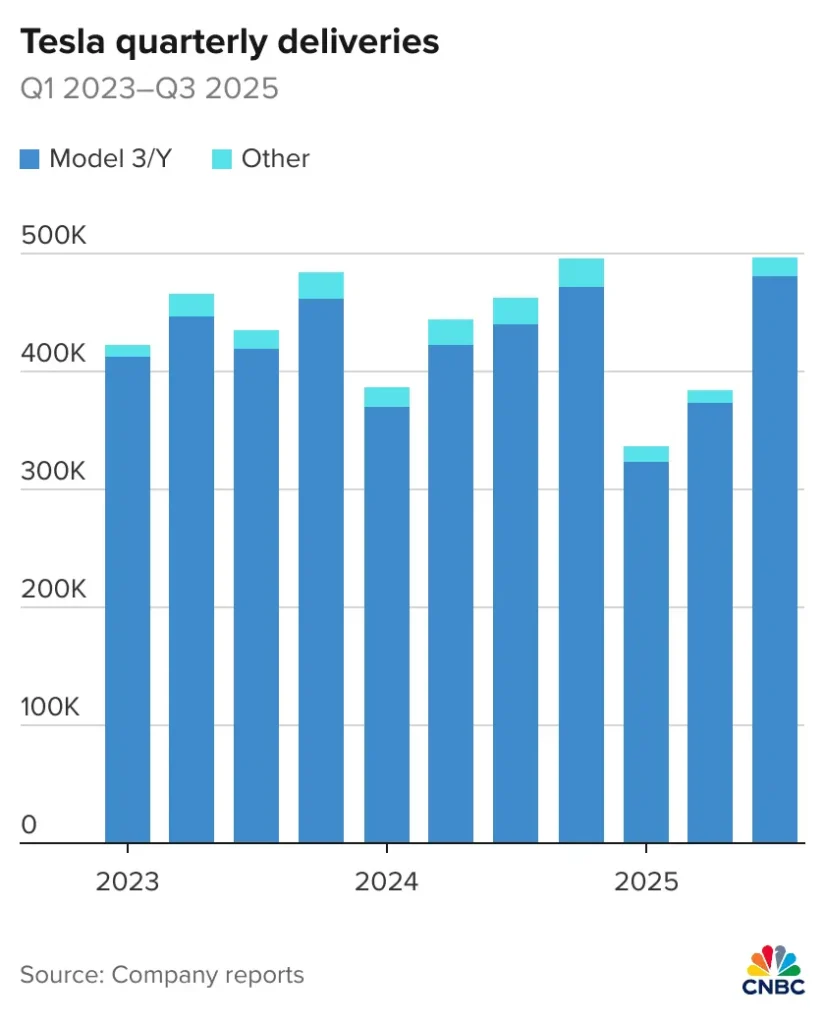

Tesla is one of the most talked-about companies today. The latest numbers show the company delivered nearly 500,000 vehicles in Q3 2025—crushing Wall Street’s expectations. Energy storage deployments reached record highs. However, with the recent launch of a lower-priced Model Y and loss of U.S. tax credits, Tesla’s future is more complicated than ever. Investors are asking: can Tesla keep growing, or is competition catching up?

Breaking Down the Recent Numbers

Big Delivery Wins

Tesla delivered 497,099 vehicles in Q3, setting a new record. Production hit over 447,000 units. This surge was partly fueled by the expiration of the $7,500 U.S. EV tax credit. Many buyers rushed their purchases, which helped boost sales before the incentive ended.

Energy Storage and New Products for Tesla

Not all of Tesla’s growth comes from cars. The company deployed 12.5 GWh of energy storage products last quarter, which is another all-time high. These new areas are becoming more important for Tesla’s future.

Tesla ’s Financial Strength: What the Numbers Say

Revenue and Profitability

Tesla’s annual revenue continues to rise fast, projected near $100 billion for 2024. Despite some ups and downs in profits, Tesla remains highly cash-rich and has a strong balance sheet. The operating margin was around 8–9% in its recent reports.

Key Ratios

- Price/Earnings (P/E): Stays very high, around 250, signaling investors expect big growth ahead.

- Debt/Equity: Very low (0.17), which points to financial stability.

- Return on Equity: Near 8%, showing a decent return compared to peers.

- Current Ratio: Over 2, so Tesla has more than enough to cover short-term obligations.

Looking at Tesla Trends: Technical and Price Analysis

Recent Price Movements

Tesla’s stock trades near 52-week highs, reflecting positive market sentiment. Over the last 30 days, prices moved between $420 and $450, with volatility driven by Model Y news and quarterly records.

Technical Signals

Indicators like the 50-day and 200-day moving averages remain bullish. The Relative Strength Index (RSI) floated near 60–65, which suggests the stock isn’t overbought. Technical analysts point to support levels around $410 and resistance in the mid–$460s. Momentum remains strong, but the stock is sensitive to downside if major news disappoints.

Fundamental Analysis of Tesla: Pros and Cons

Why Tesla Still Leads

- Innovation: Tesla’s edge comes from constant improvements, from self-driving software to vertical manufacturing.

- Brand Power: Elon Musk’s vision and aggressive branding set Tesla apart in electric vehicles.

- Global Reach: Gigafactories in China and Europe reduce production risk and serve massive new markets.

Challenges to Watch

- High Valuation: Tesla is priced for perfection. Any slip-up could hit the stock hard.

- Surging Competition: Rivals like BYD, Ford, and traditional automakers are fighting for EV leadership.

- Market Shifts: The end of U.S. tax credits and demand changes in Europe create headwinds.

Charting Tesla’s Growth: Production and Competitive Trends

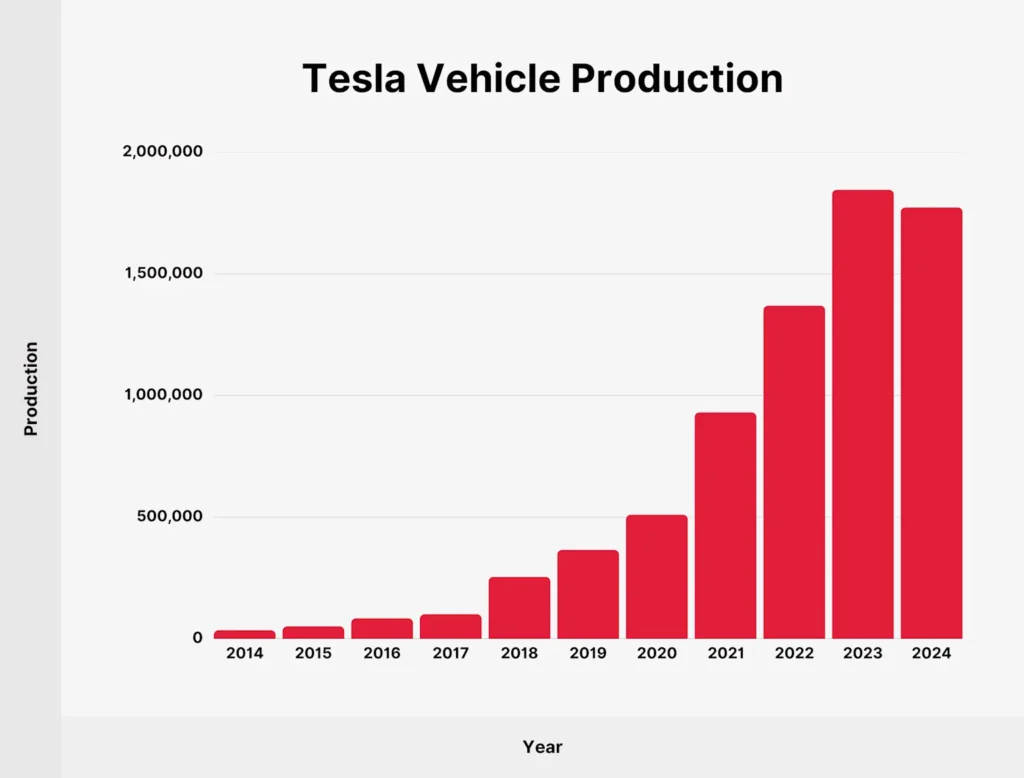

Vehicle Production: Upward Path

Recent years have seen Tesla’s vehicle production soar, nearly doubling since 2021. Even with global disruptions, the production engine powers on.

Tesla vs BYD: Competition Is Heating Up

Chinese rival BYD has now passed Tesla in total revenue and nearly matched its EV sales. The fight for global market share is tighter than ever, forcing Tesla to adjust pricing and expand lower-cost models. Still, Tesla’s faith in technology and global supply chains gives it a long-term advantage.

What’s Changing in 2025? Model Y and Price Wars

Tesla shocked the market by launching a budget-friendly Model Y, priced under $30,000. This drastic move aims to draw new buyers even as tax credits fade. However, some features have been reduced to achieve this lower price. The strategy shows Tesla’s flexibility but could squeeze profits if costs rise or rivals respond aggressively.

Production lines run fast, and Tesla can scale up or down to catch demand shifts. That agility is a huge asset in 2025’s uncertain landscape.

Smart Investor FAQs (Low Competition, High Intent Answers)

Q: Is Tesla still a good investment in 2025?

Tesla remains a market leader with robust growth, but its high valuation means short-term price swings are likely. Prospective buyers should have a long time horizon and tolerance for volatility.

Q: How do I start investing in Tesla with a small budget?

Fractional shares now make it possible to start with even $100 or less. Look for top-rated, low-fee brokers or apps—many have zero commission on U.S. shares.

Q: What are the best side hustles for introverts in 2025?

Beyond investing, consider remote freelancing, content creation, or online consulting in the EV or finance sectors. The rise of platforms for remote work makes this easier than ever.

Q: How is Tesla’s competition affecting its market position?

Competitors like BYD have cut into Tesla’s sales, especially overseas. Expect price wars, new product launches, and stiff marketing campaigns. But Tesla’s innovation pipeline remains strong.

Risks and Cautions to Keep in Mind

Stock investments are always risky. Tesla’s price can change fast on earnings, regulatory news, or new product cycles. While Tesla’s fundamentals look strong, even top analysts miss big moves.

Remember: This is only an analysis—not financial advice. Don’t make decisions purely on internet articles. Review official filings, consult independent resources, and speak with a licensed professional if you’re unsure.

Final Thoughts: Tesla’s Road Ahead in One Glance

Tesla’s growth story is powerful, but the road is bumpier in 2025. New affordable models, global competition, and uncertainty in incentives test Tesla’s staying power. Yet time and again, the company adapts, innovates, and leads. Patient investors with strong nerves—and thorough research—may still find Tesla an opportunity, but nothing is promised. Stay diversified, keep learning, and never bet more than you can afford to lose.

👉 You Might also find this post insightful – https://bosslevelfinance.com/pltr-stock-surge-what-investors-must-know-now

👉 Create a Vested Account today to start investing in US Stocks – https://refer.vestedfinance.com/RUKU88007

Source Links

- Tesla Official Press Release Q3 2025

- Moneycontrol TSLA Technical Analysis

- Economic Times Tesla Model Y Launch News

- CNN Tesla Competitor Comparison

- ChartMill Tesla Technical Analysis

- Yahoo Finance TSLA Key Statistics

- Investing.com Tesla Stock Price History

- TrendSpider TSLA Technicals

Related Reading (Low-Competition Keywords):

- “how to save $5000 in 6 months”

- “best high-yield savings accounts under $1k”

- “2025 side hustles for introverts”

- “fractional shares Tesla investment”

- “cheap electric cars 2025”

Always invest with due diligence. Markets can change quickly. This blog is for educational purposes—not investment advice.

- https://coincodex.com/stock/TSLA/price-prediction/

- https://www.moomoo.com/community/feed/tesla-q3-2025-delivery-beats-estimate-positive-outlook-115333138284950

- https://ycharts.com/companies/TSLA/pe_ratio

- https://economictimes.com/news/international/us/tesla-stock-today-why-is-tsla-falling-after-a-sudden-jump-investors-react-to-the-cheaper-model-y-launch-is-teslas-big-bet-on-affordability-backfiring-already/articleshow/124366960.cms

- https://economictimes.com/news/international/us/tesla-q3-deliveries-hit-record-497099-cars-as-us-ev-tax-credit-ends/articleshow/124278930.cms

- https://www.alphaspread.com/security/nasdaq/tsla/summary

- https://www.cnn.com/markets/stocks/TSLA

- https://www.reuters.com/business/autos-transportation/tesla-quarterly-deliveries-set-boost-expiring-ev-credit-us-2025-10-01/

- https://stockanalysis.com/stocks/tsla/statistics/

- https://www.investing.com/equities/tesla-motors-historical-data

- https://ir.tesla.com/press-release/tesla-third-quarter-2025-production-deliveries-deployments

- https://public.com/stocks/tsla/pe-ratio

- https://finance.yahoo.com/quote/TSLA/history/

- https://www.cnbc.com/2025/10/02/tesla-tsla-q3-2025-vehicle-delivery-production.html

- https://companiesmarketcap.com/tesla/pe-ratio/

- https://www.nasdaq.com/market-activity/stocks/tsla/historical

- https://www.wsj.com/business/autos/tesla-sales-q3-2025-844e1394

- https://finance.yahoo.com/quote/TSLA/key-statistics/

- https://247wallst.com/investing/2025/10/07/wall-street-price-prediction-teslas-share-price-forecast-for-2025/

- https://finance.yahoo.com/news/tesla-third-quarter-2025-production-130400530.html

- https://www.moneycontrol.com/us-markets/technical-analysis/tesla/TSLA/daily

- https://www.tipranks.com/stocks/tsla/technical-analysis

- https://www.investopedia.com/ask/answers/120314/who-are-teslas-tsla-main-competitors.asp

- https://www.youtube.com/watch?v=DfYt0RXtolM

- https://www.chartmill.com/stock/quote/TSLA/technical-analysis

- https://www.markets.com/research/byd-surpasses-tesla-in-revenue-what-is-the-prediction-of-tesla-stock

- https://trendspider.com/markets/symbols/TSLA/

- https://in.tradingview.com/symbols/NASDAQ-TSLA/technicals/

- https://www.sandicliffe.co.uk/blog/meet-the-byd-experts-your-local-team-at-sandicliffe-nottingham

- https://www.barchart.com/stocks/quotes/TSLA/technical-analysis

- https://www.investing.com/equities/tesla-motors-inc-drc-technical

- https://www.cnn.com/2024/04/03/cars/china-tesla-byd-competition-hnk-intl-dg

- https://www.kavout.com/market-lens/tesla-tsla-vs-nio-vs-byd-byddy-in-depth-comparative-analysis-for-investing-in-top-ev-stocks

- https://in.tradingview.com/symbols/NASDAQ-TSLA/

- https://www.youtube.com/watch?v=9DLwtGw5yZY

- https://in.investing.com/equities/tesla-motors-technical

- https://www.blackcircles.com/news/tesla-vs-byd

- https://www.reddit.com/r/electricvehicles/comments/1jh3v89/chinas_byd_is_now_bigger_than_ford_gm_and_vw/