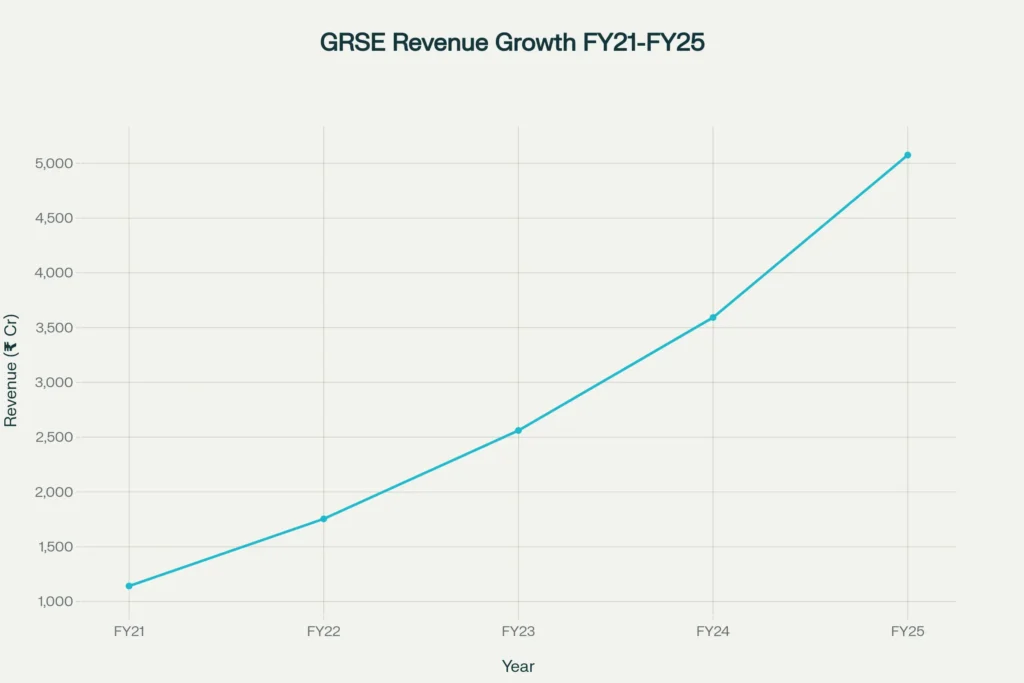

Garden Reach Shipbuilders & Engineers (GRSE) shows remarkable financial strength. The company posted 48% profit growth in FY25. Revenue surged to ₹5,076 crores from ₹3,593 crores. Strong order book of ₹22,680 crores provides revenue visibility till 2029. Recent ₹25,000 crore naval contract win positions GRSE for future growth.

However, stock trades at high valuations with PE ratio of 52.4x. Technical indicators show mixed signals with recent correction from highs. Investors should weigh growth potential against current market price.

Strong Financial Performance Drives GRSE Forward

GRSE delivered exceptional results in FY25. The shipbuilder achieved record revenue of ₹5,076 crores. This represents 41% year-over-year growth.

Net profit jumped to ₹527 crores in FY25. This marks 48% growth from previous year’s ₹357 crores. Earnings per share improved to ₹46.04 from ₹31.19.

The company maintained healthy margins despite growth. Net profit margin stood at 10.4% in FY25. EBITDA margins expanded across quarters showing operational efficiency.

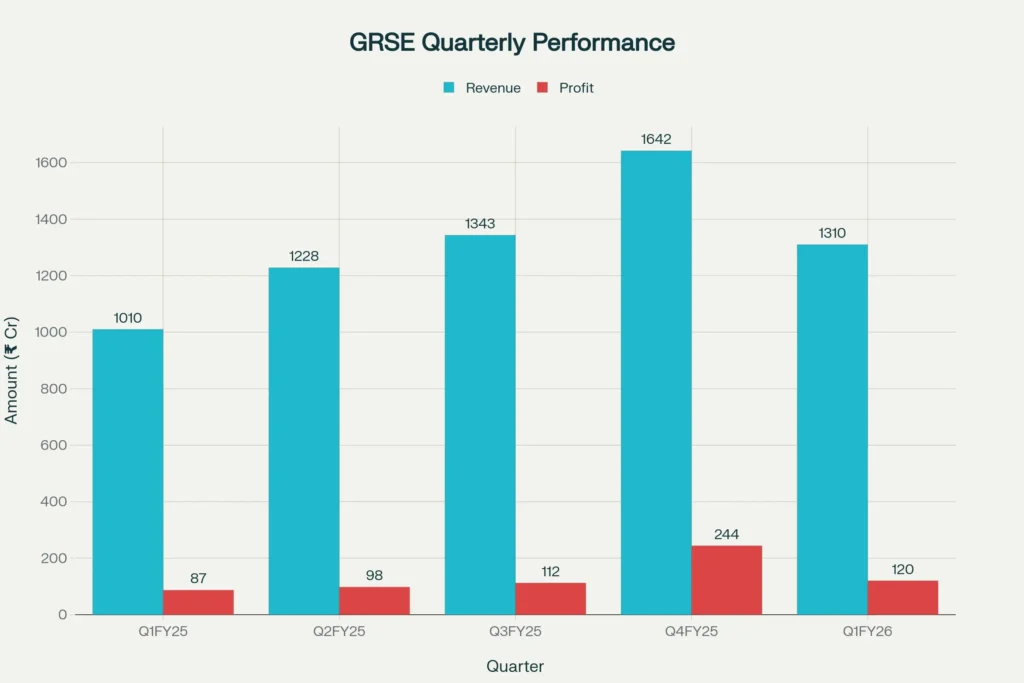

Q1 FY26 of GRSE Results Show Continued Momentum

GRSE’s latest quarterly results confirm strong execution. Q1 FY26 revenue reached ₹1,310 crores, up 30% year-over-year. Net profit grew 38% to ₹120 crores.

EBITDA nearly doubled to ₹112 crores in Q1 FY26. This compares to ₹56 crores in same quarter last year. EBITDA margin expanded to 8.5% from 5.6%.

The company shows consistent quarter-over-quarter improvement. Management expects peak execution by year-end. Strong project pipeline supports revenue growth.

GRSE Defense Contracts Secure Long-Term Growth

Garden Reach Shipbuilders & Engineers won the prestigious ₹25,000 crore naval corvette contract. This represents the largest order in company history. The contract covers five Next Generation Corvettes for Indian Navy.

Current order book stands at ₹22,680 crores as of March 2025. All projects scheduled for completion by 2029. This provides excellent revenue visibility for investors.

The company delivered 111 warships to Indian maritime forces. GRSE holds leadership position in defense shipbuilding. Government’s focus on indigenous manufacturing benefits the company.

GRSE ‘s Expanding Capacity for Future Opportunities

GRSE increased shipbuilding capacity from 20 to 28 platforms. The company established new shipyard outside Kolkata. This expansion addresses growing defense requirements.

Management targets international markets for commercial vessels. Export orders provide additional revenue streams. The company already exported warships to friendly nations.

Green warship technologies offer new growth avenues. GRSE incorporates environment-friendly features in new designs. This aligns with global sustainability trends.

Valuation Concerns Despite Strong Fundamentals

GRSE trades at premium valuation of 52.4x PE ratio. Stock price increased 1,321% over five years. Current market cap stands at ₹29,352 crores.

The stock showed 47% returns in last one year. However, recent months saw profit booking. Share price corrected from highs of ₹3,538 to current levels.

Price-to-book ratio of 14.1x indicates expensive valuation. Investors should consider entry points carefully. Market volatility affects defense stocks significantly.

Technical Analysis Shows Mixed Signals

Recent price action indicates consolidation phase. Stock formed resistance around ₹2,744 levels. Support exists near ₹2,440 zone based on recent patterns.

Moving averages show bearish crossover signals. 50-day moving average crossed below 200-day average. This indicates short-term weakness in price momentum.

RSI readings suggest oversold conditions. MACD shows negative momentum currently. However, long-term trend remains positive for defense sector.

Key Risk Factors to Consider

Defense contracts face execution delays sometimes. Complex projects may impact margins. Dependency on government orders creates revenue concentration risk.

Rising subcontracting costs affect profitability. International competition intensifies for export orders. Currency fluctuations impact overseas projects.

High valuations limit downside protection. Market sentiment affects stock price significantly. Interest rate changes impact capital-intensive business.

Investment Outlook and Strategy

GRSE offers compelling long-term growth story. Strong order book provides revenue certainty. Government’s defense spending benefits the company.

Current market price reflects optimistic expectations. Patient investors may benefit from market corrections. Dollar-cost averaging reduces timing risks for retail investors.

Three out of five analysts recommend buy rating. Average price target suggests limited upside from current levels. Investors should monitor quarterly execution progress.

Conclusion: Balanced Approach Recommended

GRSE demonstrates strong operational performance and growth potential. The company benefits from India’s defense modernization program. Robust order book ensures steady revenue growth.

However, expensive valuations warrant caution. Market conditions affect defense stocks significantly. Investors should consider entry points carefully.

👉 You Might also find this post insightful – https://bosslevelfinance.com/rtx-stock-breakout-earn-more-worry-less

👉 Create a Vested Account today to start investing in US Stocks – https://refer.vestedfinance.com/RUKU88007

This analysis is for educational purposes only. Stock markets carry inherent risks and subject to change. We do not encourage users to buy, sell or hold any stocks. Please do your own due diligence before making investment decisions.

Source Links:

- https://www.screener.in/company/GRSE/

- https://www.moneycontrol.com/india/stockpricequote/engineering-heavy/gardenreachshipbuildersengineers/GRS01

- https://ticker.finology.in/company/GRSE

- https://economictimes.com/markets/stocks/earnings/grse-q1-results-pat-surges-38-yoy-to-rs-120-crore-revenue-up-by-30/articleshow/123185616.cms

- https://www.newindianexpress.com/cities/delhi/2025/May/23/garden-reach-shipyard-to-construct-rs-25000-crore-next-gen-corvettes-for-navy

- https://www.ndtvprofit.com/quarterly-earnings/garden-reach-shipbuilders-q1-results-profit-surges-38-margin-expands

- https://simplywall.st/stocks/in/capital-goods/nse-grse/garden-reach-shipbuilders-engineers-shares/past

- https://www.tickertape.in/stocks/garden-reach-shipbuilders-and-engineers-GRSE

- https://www.screener.in/company/GRSE/

- https://www.moneycontrol.com/india/stockpricequote/engineering-heavy/gardenreachshipbuildersengineers/GRS01

- https://ticker.finology.in/company/GRSE

- https://www.smart-investing.in/main.php?Company=GARDEN+REACH+SHIPBUILDERS+%26+ENGINEERS+LTD

- https://www.tickertape.in/stocks/garden-reach-shipbuilders-and-engineers-GRSE

- https://x.com/OfficialGRSE/status/1922280626281214062

- https://economictimes.indiatimes.com/garden-reach-shipbuilders-engineers-ltd/stocks/companyid-4718.cms

- https://in.tradingview.com/symbols/NSE-GRSE/

- https://simplywall.st/stocks/in/capital-goods/nse-grse/garden-reach-shipbuilders-engineers-shares/past

- https://in.investing.com/equities/garden-reach-shipbuilders-historical-data

- https://www.nseindia.com/get-quotes/equity?symbol=GRSE

- https://www.grse.in/financial-results/

- https://groww.in/charts/stocks/garden-reach-shipbuilders-engineers-ltd

- https://www.icicidirect.com/stocks/overall-analysis/garden-reach-shipbuilders-and-engineers-ltd

- https://www.moneycontrol.com/financials/gardenreachshipbuildersengineers/balance-sheetVI/GRS01

- https://groww.in/stocks/garden-reach-shipbuilders-engineers-ltd

- https://in.investing.com/equities/garden-reach-shipbuilders-technical

- https://www.facebook.com/grsekolkata/posts/performance-review-of-q1fy26grse-begins-fy26-with-a-solid-set-of-numbers-revenue/1087910323440661/

- https://finance.yahoo.com/quote/GRSE.NS/

- https://www.moneycontrol.com/markets/financials/quarterly-results/gardenreachshipbuildersengineers-GRS01/

- https://economictimes.com/markets/stocks/earnings/grse-q1-results-pat-surges-38-yoy-to-rs-120-crore-revenue-up-by-30/articleshow/123185616.cms

- https://scanx.trade/stock-market-news/earnings/garden-reach-shipbuilders-shares-dip-2-2-ahead-of-quarterly-results/16184679

- https://www.newindianexpress.com/cities/delhi/2025/May/23/garden-reach-shipyard-to-construct-rs-25000-crore-next-gen-corvettes-for-navy

- https://www.topstockresearch.com/rt/Stock/GRSE/Candlestick

- https://www.ndtvprofit.com/quarterly-earnings/garden-reach-shipbuilders-q1-results-profit-surges-38-margin-expands

- https://www.moneycontrol.com/news/business/markets/grse-shares-up-over-3-percent-after-emerging-as-lowest-bidder-for-over-rs-25-000-crore-contract-to-build-naval-warships-13039819.html

- https://upstox.com/news/market-news/earnings/garden-reach-shipbuilders-q1-result-net-profit-rises-38-ebida-doubles-to-112-crore-yo-y/article-179456/

- https://www.linkedin.com/posts/anaadiprofessor_garden-reach-shipbuilders-engineers-ltd-activity-7333104734800691200-i-ck

- https://in.tradingview.com/symbols/NSE-GRSE/technicals/

- https://grse.in/investor-presentations/

- https://www.ndtvprofit.com/business/garden-reach-shipbuilders-and-engineers-eyes-long-term-growth-with-rs-22680-crore-order-book-p-17a-frigates-at-core

- https://www.moneycontrol.com/technical-analysis/gardenreachshipbuildersengineers/GRS01/daily

- https://www.angelone.in/news/share-market/defence-stock-grse-in-focus-to-boost-shipbuilding-capacity-establishes-new-shipyard-outside-kolkata

- https://chartink.com/stocks/grse.html

- https://grse.in/press-releases-2022-23-quarter2/