Amazon Web Services (AWS) has taken center stage in the cloud world. Demand for high-powered computing keeps climbing, and AWS remains the most profitable part of Amazon’s empire. Yet, fresh competition, huge capital costs, and customer-focus shifts create real uncertainty. In this simple deep-dive, we blend data, charts, and clear language to break down what every curious learner—or potential investor—should know.

AWS Snapshot: Why the Cloud Unit Matters

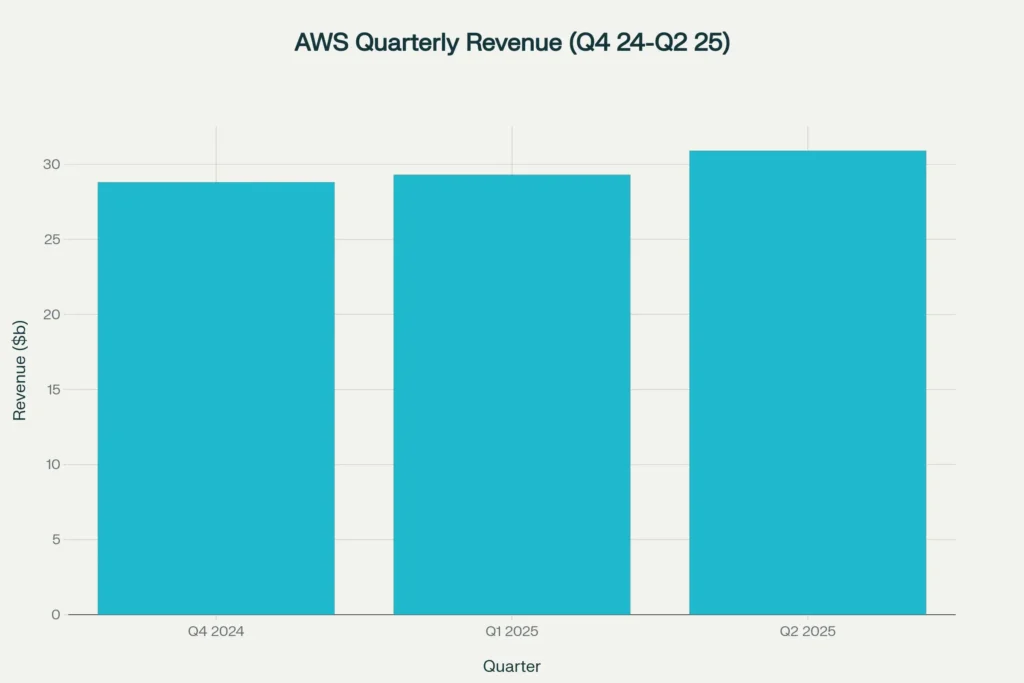

AWS supplies pay-as-you-go computing tools. Companies rent servers, storage, and AI chips instead of buying hardware. Because that model saves money and speeds innovation, clients keep flocking to AWS. In Q2 2025, AWS booked $30.9 billion in revenue, adding another strong quarter to its track record.

AWS Market Lead, Yet Growing Pressure

Although AWS still owns about one-third of global cloud share, rivals are sprinting. Microsoft Azure and Google Cloud are growing faster. Therefore, AWS needs constant innovation. Even so, scale and brand trust give AWS an edge.

Global Cloud Rank

- AWS – ~30% share

- Azure – ~21%

- Google Cloud – ~12%

Because these three giants control more than 60% of the market, any shift in share grabs headlines. AWS keeps announcing new data center regions and custom silicon chips to defend its lead.

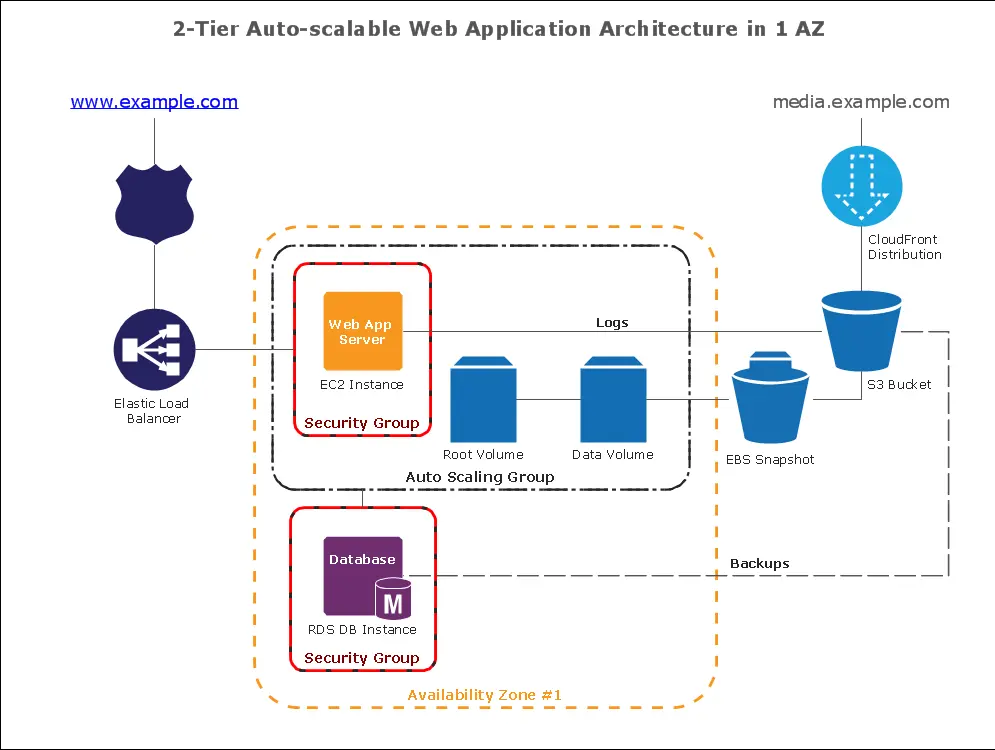

How AWS Earns Its Money

At heart, the unit sells four profit engines:

- Compute (EC2 & Lambda). Pay only for what you run.

- Storage (S3 & Glacier). Scale up and down, avoid hardware bills.

- Databases (RDS, DynamoDB). Managed systems free teams from patching.

- AI & Analytics (Bedrock, Trainium). Ready-made tools for machine learning.

Because pricing is consumption-based, usage spikes boost revenue. That elastic model caused AWS gross margins to hover near 40% this year.

Key Growth Drivers

AI Wave

Generative AI pushes firms to seek big GPU clusters. AWS answers with Trainium2 chips and Bedrock model hosting. Many start-ups skip on-premise hardware entirely, choosing AWS for speed and lower risk.

On-Premise Migration

More than 80% of corporate IT spending still lives in private data centers. Over time, workloads shift to cloud platforms. Each new migration expands AWS’s base.

New Regions

Fresh sites in Chile, Malaysia, and New Zealand reduce latency for local users. Local governments often demand data residency, so a wider footprint keeps AWS attractive.

Risks That Could Trip Up AWS

Slower Growth

While Q2 2025 increased 18% year over year, that pace is below earlier highs. Should macro spending tighten, growth could slow further.

Massive Capital Needs

AI servers cost billions. AWS must spend upfront to add capacity, even before revenue arrives. If demand misfires, returns can lag.

Customer Concentration Concerns

Large clients like Netflix, Salesforce, and even the U.S. government account for big chunks of usage. Because each renewal is a bargaining chip, price pressure may rise.

Regulatory Scrutiny

Data-sovereignty rules add costs. Antitrust eyes watch every move. Compliance spending, therefore, goes up.

Fundamental Check-Up

| Metric | Q2 2025 | YoY Change |

|---|---|---|

| Revenue | $30.9 B | +18% |

| Operating Income | $10.2 B | –7% |

| Margin | 33% | –3 ppts |

Margins dipped because AI hardware outlays hit the income line. Even so, AWS remains Amazon’s prime profit engine.

Cash Flow and Debt Signals

Amazon’s total cash pile sits near $95 billion. Roughly half of annual capital spending now supports new AWS capacity. Although Amazon carries a healthy credit rating, continued spending could push net debt higher if free cash flow weakens.

Competitive Landscape

| Feature | AWS | Azure | Google Cloud |

|---|---|---|---|

| Market Share | 30% | 21% | 12% |

| AI Chip Strategy | In-house Trainium | Azure + NVIDIA | TPU |

| Hybrid Offerings | Outposts / EKS Anywhere | Arc | Anthos |

| Price Flexibility | Spot, Savings Plans | Hybrid Benefit | Sustained Use |

Each rival touts unique perks. Yet, AWS’s broad catalog and early lead remain hard to beat.

Investor Angle: Upside vs. Downside

Upside:

– AI boom fuels higher usage.

– New regions unlock fresh demand.

– Operating leverage returns once big hardware cycles pass.

Downside:

– Spending mis-timed; margins stay lower.

– Competitive gales erode share.

– Regulation slows expansion in key regions.

Action Points for Curious Learners

- Track AWS quarterly revenue and margin trends.

- Watch capital-expenditure guidance for AI servers.

- Compare growth rates against Azure and Google Cloud.

- Monitor large contract wins or churn announcements.

Practical Tips for Cloud Users

– Leverage Savings Plans or Spot Instances to cut bills fast.

– Use AWS Cost Explorer weekly to catch surprise spend.

– Start small with serverless tools like Lambda to avoid idle costs.

AWS and Everyday Innovation

Behind every viral app or same-day delivery sits cloud plumbing. Developers build faster. Small firms launch global services overnight. Because AWS abstracts infrastructure pain, creators focus on customer joy.

Final Thoughts

AWS remains a powerhouse, balancing thrilling revenue growth with real strategic pitfalls. Its reach touches nearly every digital experience we enjoy. Therefore, staying informed about its wins and risks helps both tech watchers and investors keep perspective.

You Might also find this post insightful – https://bosslevelfinance.com/crwv-ai-cloud-leader-driving-massive-growth

Disclaimer

This article is educational analysis only. We do not urge anyone to buy, sell, or hold any security. Markets shift fast. Always conduct your own due diligence before acting on any financial idea.

Sources:

– CNBC AWS Q2 2025 earnings report

– Futurum Q1 2025 earnings review

– DatacenterDynamics AWS revenue story

– CRN cloud provider comparison Q4 2024

– Statista cloud market share graphic

– IDC business value whitepaper on AWS

– AWS investor relations press releases

Here are the source links referenced for the AWS blog post:

- CNBC AWS Q2 2025 earnings report: https://www.cnbc.com/2025/07/31/aws-q2-2025-earnings-report-amazon-cloud.html

- Futurum Q1 2025 earnings review: https://futurumgroup.com/insights/amazon-q1-fy-2025-earnings-reflect-cloud-momentum-operating-margin-gains/

- DatacenterDynamics AWS revenue story: https://www.datacenterdynamics.com/en/news/aws-revenue-reaches-293bn-for-q1-2025-up-17-yoy/

- CRN cloud provider comparison Q4 2024: https://www.crn.com/news/cloud/2025/aws-vs-microsoft-vs-google-cloud-earnings-q4-2024-face-off

- Statista cloud market share graphic: https://www.statista.com/chart/18819/worldwide-market-share-of-leading-cloud-infrastructure-service-providers/

- IDC business value whitepaper on AWS: https://pages.awscloud.com/rs/112-TZM-766/images/IDC-Whitepaper-The-Business-Value-of-AWS-Global.pdf

- AWS investor relations press releases: https://ir.aboutamazon.com/news-release/news-release-details/2025/Amazon-com-Announces-Second-Quarter-Results/