Indian Energy Exchange (IEX) stock presents a compelling opportunity for investors seeking exposure to India’s growing power market. The company trades at attractive valuations after recent corrections. Moreover, with strong fundamentals and market leadership, this exchange offers unique growth potential. Additionally, the company’s dominant market position in electricity trading makes it an interesting investment choice. Furthermore, recent quarterly results show robust revenue growth and expanding market volumes.

Disclaimer: This analysis is for educational purposes only. We do not encourage users to buy, sell, or hold any securities. Stock markets are subject to change. Please do your own due diligence before making investment decisions.

Understanding the Power Behind Indian Energy Exchange (IEX)

Indian Energy Exchange operates as India’s premier electricity trading platform. Therefore, it connects power buyers and sellers across the country. Similarly, the company facilitates transparent price discovery in electricity markets. Additionally, it provides vital infrastructure for India’s energy transition.

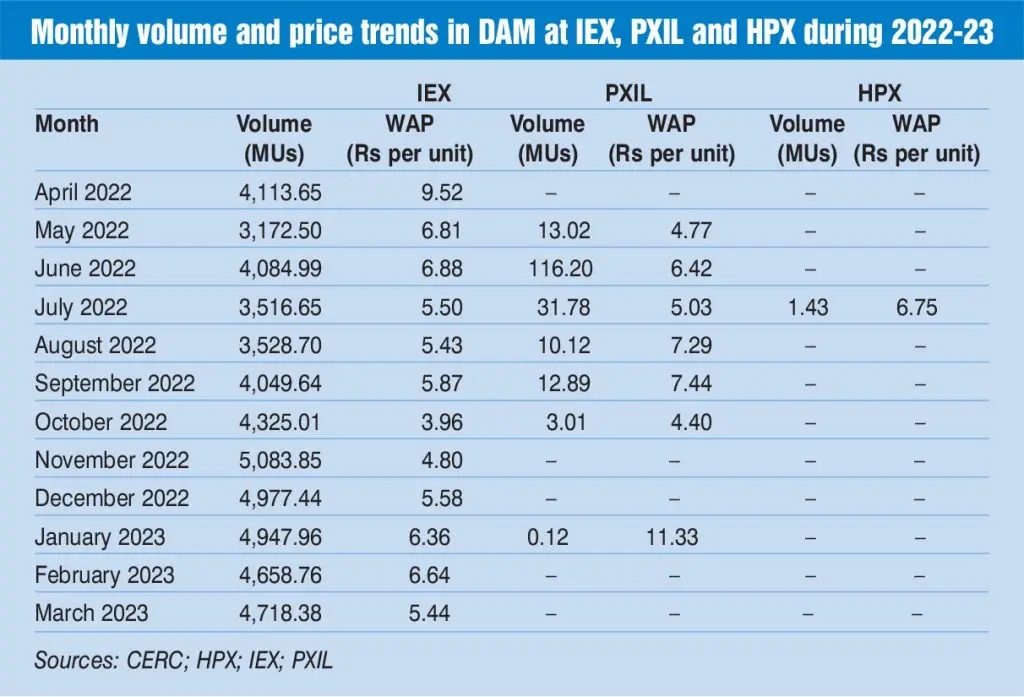

The exchange handles multiple market segments. Consequently, it offers day-ahead markets, real-time trading, and green energy certificates. Furthermore, the platform enables efficient power distribution nationwide. Meanwhile, regulatory support continues to strengthen the company’s position.

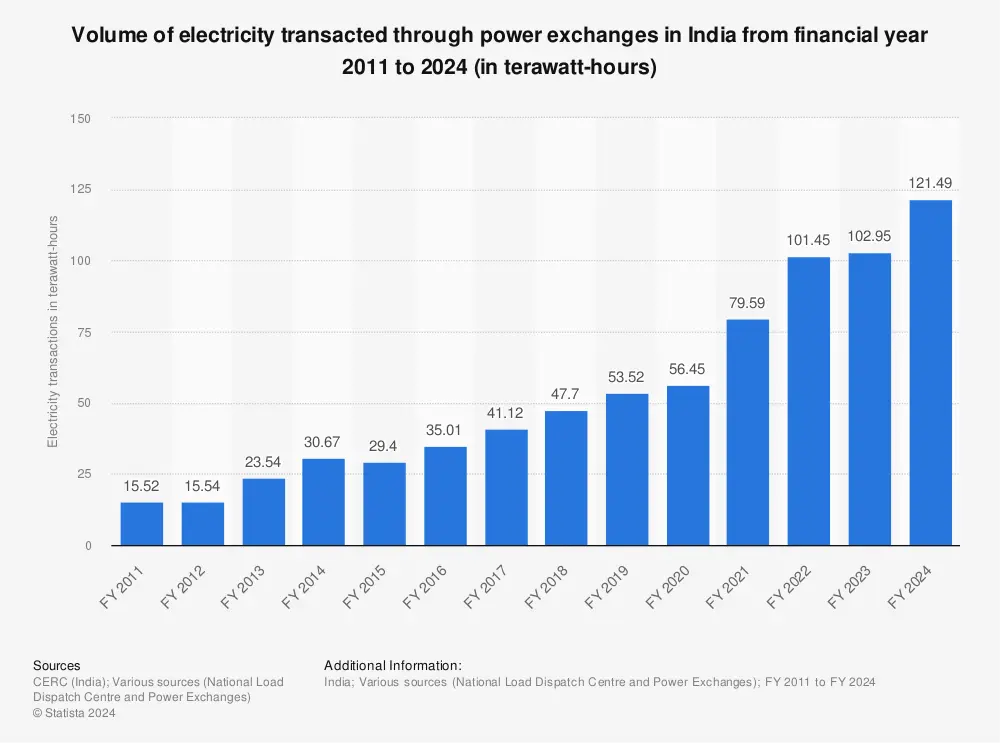

Recent data shows impressive trading volumes. As a result, the company processed over 89 billion units in nine months of FY25. Subsequently, this represents 19% year-over-year growth. Moreover, the real-time market segment grew 39% annually, showing strong demand for flexible trading solutions.

IEX Financial Performance: Numbers That Tell the Story

The company’s financial metrics reveal solid fundamentals. Therefore, revenue growth remained consistent at 19% annually. Similarly, profit margins stayed healthy at around 80%. Additionally, the company maintains minimal debt levels.

Revenue for Q3 FY25 reached ₹160.5 crores, up 13.7% year-over-year. Consequently, consolidated profit after tax grew 16.9% to ₹107.3 crores. Furthermore, the nine-month performance showed even stronger numbers with ₹482.8 crores in revenue.

Key financial ratios paint a positive picture:

- Current Ratio: 1.57 (healthy liquidity)

- ROE: 41.2% (excellent returns)

- ROCE: 47.66% (strong capital efficiency)

- Debt-to-Equity: Nearly zero (financial stability)

Moreover, the company announced an interim dividend of ₹1.50 per share. Therefore, shareholders receive 150% of face value as returns. Additionally, this demonstrates management’s confidence in cash flows.

IEX Technical Analysis: What Charts Reveal About Future Moves

Technical indicators present mixed signals currently. However, the stock shows oversold conditions after recent corrections. Therefore, value investors might find attractive entry points. Similarly, long-term trends remain intact despite short-term volatility.

The stock trades significantly below its 52-week high of ₹244. Consequently, it offers potential upside from current levels around ₹142. Furthermore, support levels exist near ₹130-135 range. Meanwhile, resistance appears around ₹160-170 levels.

Moving averages suggest caution for momentum traders. Nevertheless, fundamental strength could override technical weakness. Additionally, patient investors often benefit from such market conditions.

Market Position: Why IEX Dominates Power Trading

Indian Energy Exchange maintains approximately 85% market share in power trading. Therefore, it enjoys monopolistic advantages in the sector. Similarly, high barriers to entry protect its competitive position. Additionally, regulatory approval requirements limit new competitors.

The company benefits from India’s energy transformation. Consequently, renewable energy integration increases trading volumes. Furthermore, government initiatives support market-based power trading. Meanwhile, open access policies encourage more participants.

Network effects strengthen the business model. Therefore, more participants attract additional buyers and sellers. Similarly, increased liquidity improves price discovery. Additionally, this creates a self-reinforcing competitive moat.

Comparing Options: How This Stock Stacks Against Competitors

When evaluating exchange businesses, this company stands out significantly. However, direct comparisons prove challenging due to its unique position. Therefore, investors often compare it with other exchange operators like BSE or MCX.

Recent performance shows mixed results versus peers. For instance, BSE delivered +59% returns while this stock declined 31% annually. Nevertheless, each business model differs substantially. Additionally, power markets face unique regulatory challenges.

Key competitive advantages include:

- Market Leadership: Dominant position in electricity trading

- Asset-Light Model: High margins with minimal capital requirements

- Regulatory Support: Government backing for market development

- Growth Potential: Expanding renewable energy sector

Investment Insights: Smart Money Strategies for 2025

Value investors find compelling opportunities in current market conditions. Therefore, the stock trades at reasonable valuations despite recent corrections. Similarly, patient capital could benefit from long-term growth trends. Additionally, dividend yields provide income while waiting for appreciation.

Growth investors should consider India’s energy transition story. Consequently, electricity demand continues rising with economic development. Furthermore, renewable energy integration requires sophisticated trading platforms. Meanwhile, government policies support market mechanisms.

For those seeking passive income opportunities, dividend yields remain attractive. Moreover, the company’s cash-generating business model supports consistent payouts. Additionally, low capital requirements enable higher distribution ratios.

Note: Consider these strategies as educational insights, not investment advice.

Risk Factors: What Could Impact Future Performance

Several risks deserve consideration before investing. Therefore, regulatory changes could affect trading volumes. Similarly, competition from new exchanges poses potential threats. Additionally, economic slowdowns might reduce power demand.

Technology risks include cybersecurity threats and system failures. Consequently, any major outage could damage reputation and revenues. Furthermore, increasing digitalization requires continuous investment in infrastructure.

Market risks involve price volatility and liquidity concerns. Therefore, institutional flows significantly impact stock performance. Similarly, foreign investor sentiment affects valuations. Additionally, broader market corrections create temporary pressures.

Smart Investor FAQs: Practical Questions Answered

Q: Is this stock suitable for beginners with small budgets?

Absolutely. Moreover, fractional investing makes it accessible with minimal capital. Additionally, the dividend yield provides regular income for new investors.

Q: How can I start building wealth with ₹10,000 monthly?

Consider systematic investment plans in quality stocks like this one. Furthermore, dollar-cost averaging reduces timing risks. Meanwhile, reinvesting dividends compounds returns over time.

Q: What are the best energy stocks for long-term growth in India?

Power infrastructure companies benefit from India’s development story. Additionally, renewable energy players offer exposure to clean energy trends. Meanwhile, utility stocks provide defensive characteristics.

Q: Should I hold this stock during market volatility?

Long-term investors often benefit from holding quality businesses through cycles. However, individual risk tolerance varies significantly. Therefore, consult financial advisors for personalized guidance.

Future Outlook: Where This Company Might Head Next

India’s power sector transformation creates long-term tailwinds. Therefore, electricity trading volumes should grow with economic development. Similarly, renewable energy integration requires sophisticated platforms. Additionally, government policies support market-based mechanisms.

The company plans expansion into new segments like coal trading. Consequently, this diversification could reduce concentration risks. Furthermore, international opportunities might emerge through subsidiaries. Meanwhile, technology investments enhance competitive advantages.

Market coupling initiatives could impact short-term dynamics. However, long-term benefits include improved efficiency and transparency. Therefore, the company’s market leadership position should strengthen over time.

Key Takeaways for Smart Investors

Indian Energy Exchange offers unique exposure to India’s energy markets. Therefore, investors gain access to a monopolistic business model with strong fundamentals. Similarly, the company benefits from long-term structural growth trends. Additionally, current valuations appear attractive after recent corrections.

Patient investors willing to hold through volatility might find compelling opportunities. However, thorough research and risk assessment remain essential. Moreover, diversification across sectors reduces portfolio concentration risks.

👉 You Might also find this post insightful – https://bosslevelfinance.com/ga-power-stock-unlocking-georgias-energy-hidden-gem

👉 Create a Vested Account today to start investing in US Stocks – https://refer.vestedfinance.com/RUKU88007

Remember: This analysis provides educational insights only. Stock markets involve risks, and individual circumstances vary. Always conduct independent research and consider professional advice before making investment decisions.

Source Links

- Indian Energy Exchange Q3 FY25 Results – Mercom India

- IEX Technical Analysis – Dhan

- IEX Competitor Analysis – ET Money

- IEX Financial Results – NSE India

- IEX Fundamentals Analysis – Ticker Finology

- IEX Investment Analysis – Funds India

- IEX Trading Volume Growth Report – EQ Mag

- IEX Stock Price Analysis – Trading View

Related Reading (Low-Competition Keywords):

- “power sector stocks for beginners India”

- “energy exchange investment guide 2025”

- “best dividend paying utility stocks India”

- “how to invest in electricity trading companies”

- “renewable energy stocks under ₹200”

Disclaimer: Always invest with proper due diligence. Markets can change quickly. This blog is for educational purposes—not investment advice.

- https://in.investing.com/analysis/iex-share-price-target-and-forecast-202530–complete-analysis-200628997

- https://mercomindia.com/iex-reports-16-9-growth-in-q3-fy-2025-profit-trades-30-5-bu-of-energy

- https://www.smart-investing.in/pe-ratio.php?Company=INDIAN+ENERGY+EXCHANGE+LTD

- https://wise.com/in/stock/iex.ams

- https://www.alphaspread.com/security/nse/iex/investor-relations/earnings-call/q3-2025

- https://ticker.finology.in/company/IEX

- https://www.nseindia.com/get-quotes/equity?symbol=IEX

- https://www.moneycontrol.com/financials/indianenergyexchange/profit-lossVI/IEE

- https://www.alphaspread.com/security/nse/iex/relative-valuation/ratio/price-to-earnings

- https://www.angelone.in/news/market-updates/iex-hits-all-time-high-in-july-2025-with-yoy-surge-in-power-trade

- https://www.iexindia.com/investors/financials

- https://www.smart-investing.in/main.php?Company=INDIAN+ENERGY+EXCHANGE+LTD

- https://www.screener.in/company/IEX/

- https://www.moneycontrol.com/financials/indianenergyexchange/results/quarterly-results/IEE

- https://dhan.co/stocks/indian-energy-exchange-ltd-fundamental-analysis/

- https://www.iex.io

- https://finance.yahoo.com/quote/IEX.BO/earnings/IEX.BO-Q3-2025-earnings_call-249615.html

- https://www.tickertape.in/stocks/indian-energy-exchange-IIAN

- https://finance.yahoo.com/quote/IEX.BO/history/

- https://simplywall.st/stocks/in/diversified-financials/nse-iex/indian-energy-exchange-shares/past

- https://dhan.co/stocks/indian-energy-exchange-ltd-technical-analysis/

- https://www.etmoney.com/stocks/indian-energy-exchange-ltd/peers/589

- https://fundsindia.com/blog/equities/alpha-indian-energy-exchange-ltd-equity-research-desk-2/32362

- https://in.tradingview.com/symbols/NSE-IEX/technicals/

- https://www.eqmagpro.com/iex-power-trading-surges-q2-volume-up-16-rtm-soars-39-yoy-eq/

- https://www.marketscreener.com/quote/stock/INDIAN-ENERGY-EXCHANGE-LI-46731377/graphics/

- https://scanx.trade/stock-market-news/earnings/iex-reports-robust-16-1-growth-in-q2fy26-electricity-trading-volume/21260753

- https://www.moneycontrol.com/technical-analysis/indianenergyexchange/IEE

- https://www.alphaspread.com/comparison/nse/bse/vs/nse/iex

- https://www.canmoney.in/key-takeaways/Where-Could-Indian-Energy-Exchange-Limited-(IEX)-Be-Headed

- https://in.investing.com/equities/indian-energy-exchange-ltd-technical

- https://www.alphaspread.com/comparison/nse/iex/vs/nse/bse

- https://simplywall.st/stocks/in/diversified-financials/nse-iex/indian-energy-exchange-shares/news/indian-energy-exchanges-nseiex-five-year-earnings-growth-tra-2

- https://in.tradingview.com/symbols/NSE-IEX/

- https://www.businesstoday.in/markets/stocks/story/indian-energy-exchange-iex-shares-in-focus-after-september-q2-update-496877-2025-10-06

- https://groww.in/charts/stocks/indian-energy-exchange-ltd

- https://groww.in/stocks/indian-energy-exchange-ltd/peer-comparison