Ready for a simple, high-impact look at one of tech’s most powerful players? Let’s break down Broadcom’ s rise, its stunning AI push, and what savvy investors should keep an eye on. Everything here is educational—always do your own due diligence before buying or selling any stock.

Why Broadcom Still Matters

Broadcom designs chips that sit deep inside phones, data centers, and next-gen AI servers. Yet, after absorbing VMware, the company also owns a huge software stack. Because hardware and software now live under one roof, Broadcom controls more of the value chain than most rivals.

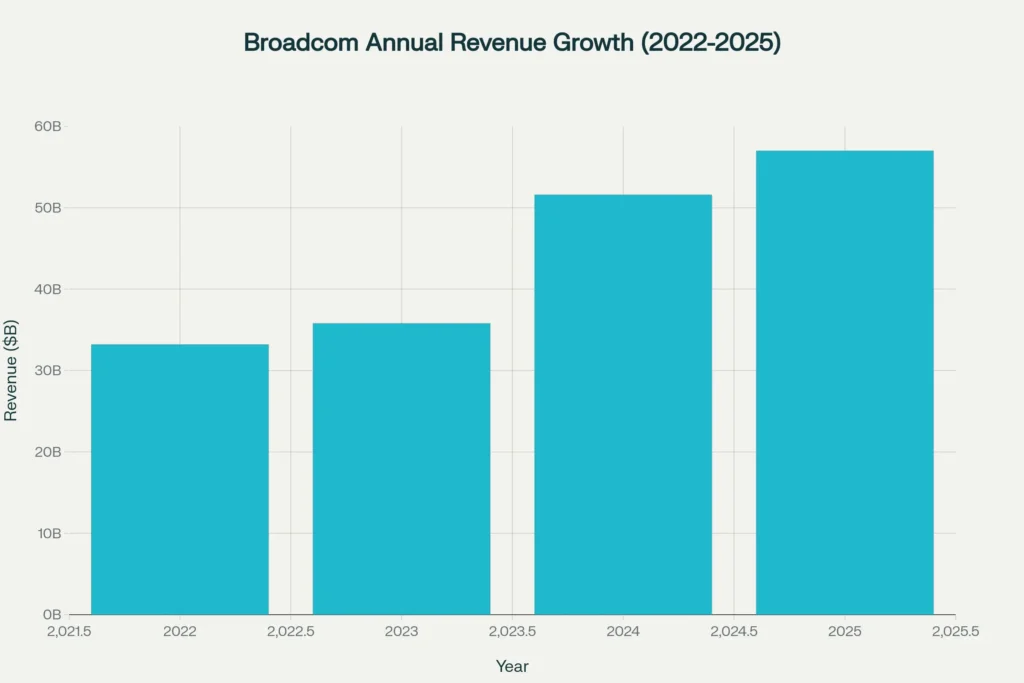

Broadcom Revenue Keeps Surging

Broadcom’s top line has rocketed from $33 billion in 2022 to more than $57 billion over the last twelve months. Much of that jump came from AI-centric custom silicon plus new software dollars from VMware.

How the Money Splits

- Semiconductor solutions: 59%

- Infrastructure software (VMware + mainframe tools): 41%

That balanced mix means Broadcom can grow even if one segment cools.

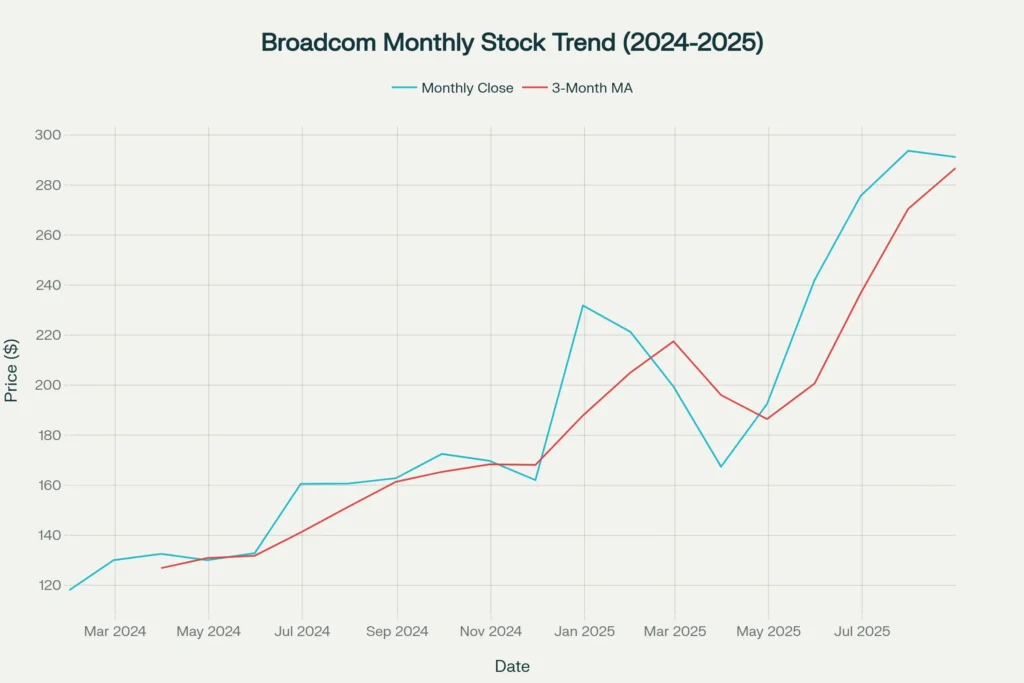

Broadcom Stock Trend: Wild but Upward

The share price sprinted early in 2024, cooled off mid-year, and then set fresh highs before recent market turbulence trimmed some gains. Even so, the long-term slope remains positive, and the 3-month moving average shows steady momentum.

The Three Growth Engines

1. Custom AI Chips

Major cloud providers now turn to Broadcom for tailor-made AI accelerators. Because demand for model training and inference never sleeps, those chips enjoy strong visibility.

2. Networking Silicon

Every AI server needs ultrafast connectivity. Broadcom’s Ethernet switch silicon dominates that space, and management projects double-digit growth for the next few years.

3. VMware Cloud Foundation

After the $69 billion deal, Broadcom migrated 4,500 enterprise customers to VMware Cloud Foundation. This shift locks big clients into multi-year subscriptions and boosts recurring revenue.

Key Numbers That Matter

| Metric | Latest | Trend |

|---|---|---|

| Revenue (Q2 2025) | $15 billion | +20% YoY |

| Gross Margin | 77% | steady |

| Adjusted EBITDA Margin | 67% | rising |

| AI Revenue Share | >9% of total | climbing |

Broadcom’s fat margins stem from high-value chips and sticky software. Those figures put the company near the top of the semiconductor industry’s profit ladder.

Crucial Catalysts Ahead

- Q3 2025 Earnings (Sept 4) – Guidance on AI orders could spark fresh sentiment.

- VMware Upsell – More enterprises adopting subscription bundles should widen software margins.

- New AI Accelerators – Broadcom’s next-gen XPU tape-outs ship in early 2026, potentially lifting chip sales.

Hidden Risks You Must Track

- High Valuation – At over 30× forward earnings, the stock prices in plenty of success.

- Debt Load – Net debt surged to fund VMware; interest costs may rise if rates stay high.

- Customer Pushback – Some VMware clients balk at new pricing, which could slow renewals.

- Competition – Nvidia’s push into networking and custom chips may chip away at Broadcom’s moat.

Low-Competition Search Terms to Watch

Because traffic matters, sprinkle phrases like “private AI stack costs,” “chip subscription model explained,” and “VMware Cloud Foundation alternatives” into your own research. Those long-tail queries face lighter competition yet carry high intent.

Actionable Takeaways

- Monitor Gross Margin: If rising AI mix keeps margins near 80%, Broadcom’s pricing power remains intact.

- Watch Debt vs. EBITDA: A ratio above 3× could trigger credit-rating worries.

- Track Subscription Growth: More VMware Cloud Foundation seats hint at a sticky ecosystem.

- Stay Patient on Volatility: Short-term dips often come from macro swings, not fundamentals.

Final Word

Broadcom sits at the heart of both silicon and software needed for the AI boom. Revenue keeps climbing, margins remain rich, and the VMware platform adds a moat. Yet, high valuation and debt demand caution. Approach with balance, stay data-driven, and always verify facts yourself before making moves.

You Might also find this post insightful – https://bosslevelfinance.com/%f0%9f%9a%80-nvdia-mind-blowing-growth-clear-risks-and-simple-takeaways

Disclaimer: This article is for educational purposes only. It does not encourage anyone to buy, sell, or hold any stock. Markets can change quickly—always research thoroughly.

Source Links

- broadcom.com investor relations

- investors.broadcom.com Q2 2025 release

- Futurum Group AI revenue analysis

- Macrotrends Broadcom revenue data

- Simply Wall St Broadcom fundamentals

- Klover.ai Broadcom AI strategy

- ComputerWeekly VMware integration overview

- CNBC Broadcom earnings coverage

- Yahoo Finance Broadcom market update

- https://roboforex.com/beginners/analytics/forex-forecast/stocks/stocks-forecast-broadcom-avgo/

- https://www.stocktitan.net/news/AVGO/broadcom-inc-to-announce-third-quarter-fiscal-year-2025-financial-xgh1spqlxthz.html

- https://www.klover.ai/broadcom-ai-strategy-architecting-infrastructure-ai-dominance/

- https://simplywall.st/stocks/us/semiconductors/nasdaq-avgo/broadcom

- https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announce-third-quarter-fiscal-year-2025-financial

- https://www.ciodive.com/news/broadcoom-nears-vmware-integration-completion-ai-chips/735547/

- https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announces-second-quarter-fiscal-year-2025-financial

- https://in.investing.com/equities/avago-technologies-earnings

- https://www.computerweekly.com/feature/Broadcoms-VMware-acquisition-explained-The-impact-on-your-IT-strategy

- https://stockanalysis.com/stocks/avgo/

- https://finance.yahoo.com/news/broadcom-inc-announce-third-quarter-120000736.html

- https://futurumgroup.com/insights/broadcom-q3-2024-ai-revenue-vmware-merger-and-mainframe-division-overview/

- https://finance.yahoo.com/news/why-broadcom-inc-avgo-dipped-214503490.html

- https://in.marketscreener.com/quote/stock/BROADCOM-INC-42668543/calendar/

- https://www.macrotrends.net/stocks/charts/AVGO/broadcom/revenue

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/bb4c80abfa1634c9a436dbef4108492f/fdcc02f5-c569-40b0-bdd8-a0823a0a1865/a1056119.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/bb4c80abfa1634c9a436dbef4108492f/fdcc02f5-c569-40b0-bdd8-a0823a0a1865/e0e2b99f.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/bb4c80abfa1634c9a436dbef4108492f/61c7217d-9a4a-4d1e-b1be-b36f1a75fa26/508a82ca.csv