Have you ever wondered why tech stocks move together like a flock of birds? Similarly, the technology-heavy index (Nasdaq Composite) has become the heartbeat of modern investing. Furthermore, understanding this relationship can unlock serious wealth-building opportunities for smart investors.

Current Market Snapshot

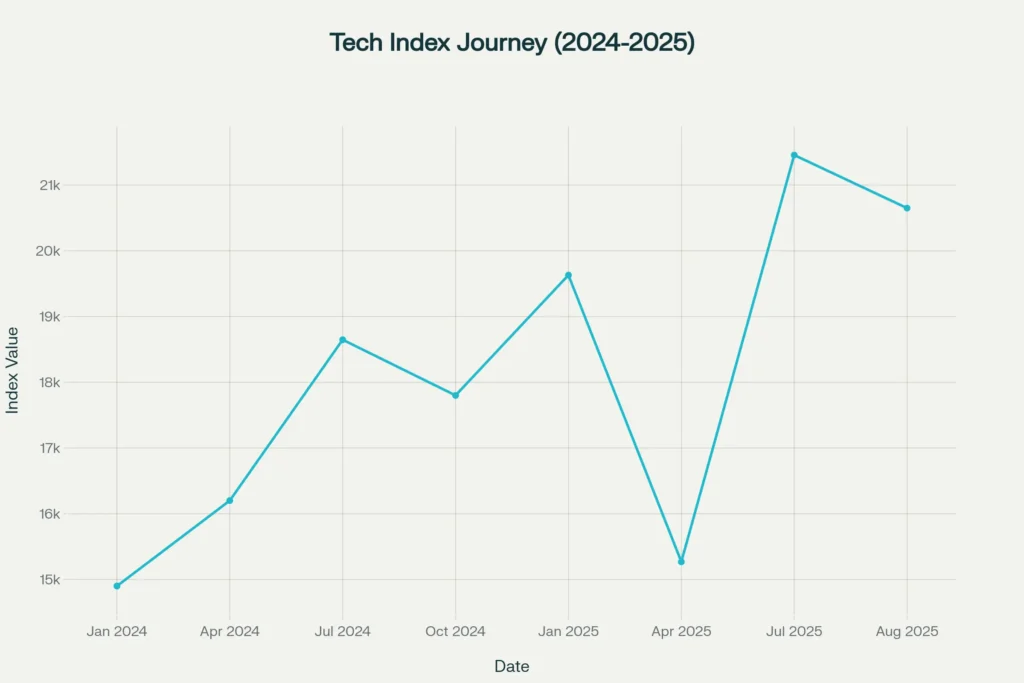

Currently, the tech index sits at 20,650 points. Meanwhile, this represents a 23% gain over the past year. Additionally, the index has shown remarkable resilience despite recent market turbulence.

Moreover, the index reached an all-time high of 21,457 in July 2025. However, it quickly pulled back due to profit-taking and economic concerns. Therefore, smart investors see this as a potential buying opportunity.

What Drives This Index

Essentially, this index tracks over 3,000 stocks listed on the tech-heavy exchange. Furthermore, it includes everything from mega-cap giants to small growth companies. Most importantly, technology companies make up about 50% of the total weight.

The biggest players include household names you use daily. For instance, Apple contributes roughly 8% of the index weight. Similarly, Microsoft adds another 7%, while NVIDIA holds about 6%. Therefore, when these giants move, the entire index follows.

The Numbers Tell a Story

Let’s examine the recent performance data. First, the index gained 29.6% in 2024, outperforming most global markets. Second, it has delivered average annual returns of 11.2% over the past decade. Third, volatility remains manageable at around 22% annually.

However, 2025 started with challenges. Specifically, the index dropped 8.2% in March due to banking sector concerns. Nevertheless, it recovered strongly, reaching new highs by summer. Therefore, patient investors were rewarded for staying the course.

Sector Breakdown Analysis

Technology stocks dominate with a 48% weighting. Additionally, consumer discretionary holds 12%, while healthcare represents 8%. Furthermore, communication services contribute 7% of the total index value.

This concentration creates both opportunities and risks. On one hand, tech innovation drives outsized returns. On the other hand, sector-specific downturns can cause significant losses. Therefore, diversification within your portfolio remains crucial.

Why Smart Money Loves This Index

Professional investors favor this index for several reasons. First, it captures the innovation economy perfectly. Second, many companies show explosive growth potential. Third, the index benefits from global digitalization trends.

Moreover, the index has consistently outperformed during economic expansions. Additionally, it tends to recover faster from recessions compared to traditional sectors. Therefore, long-term investors often use it as a core holding.

Technical Analysis Insights

Looking at the charts, several patterns emerge. Currently, the index trades above its 200-day moving average, indicating a bullish trend. However, it recently broke below short-term support levels, suggesting some weakness.

The relative strength index sits at 45, showing neutral momentum. Meanwhile, trading volume has increased during recent declines, indicating distribution. Therefore, cautious optimism seems appropriate for the near term.

Investment Strategies That Work

Rather than trying to time the market, consider systematic approaches. For example, dollar-cost averaging works exceptionally well with volatile indices. Additionally, rebalancing quarterly helps capture returns while managing risk.

Furthermore, many successful investors use market dips to build positions. Specifically, they increase buying when the index drops 10% or more. However, they always maintain adequate cash reserves for unexpected opportunities.

Risks Every Investor Should Know

Despite attractive returns, several risks warrant attention. First, high valuations make the index vulnerable to corrections. Second, interest rate changes significantly impact growth stocks. Third, regulatory pressure on tech giants continues growing.

Additionally, geopolitical tensions affect semiconductor and technology companies. Furthermore, economic slowdowns typically hit growth stocks harder than defensive sectors. Therefore, position sizing becomes critically important.

Long-Term Wealth Building Potential

History suggests patient investors get rewarded handsomely. Over the past 30 years, the index has created enormous wealth for shareholders. Moreover, technological innovation shows no signs of slowing down.

Consider this: companies in the index are leading artificial intelligence development. Similarly, they dominate cloud computing, e-commerce, and digital payments. Therefore, they’re positioned to benefit from multiple secular trends.

How to Build Your Position

Start with affordable amounts that won’t stress your budget. For instance, invest $200-500 monthly through index funds or ETFs. Additionally, increase contributions during market declines when possible.

Furthermore, consider tax-advantaged accounts for long-term holdings. Specifically, maximize contributions to 401(k) and IRA accounts. Moreover, reinvest all dividends to compound your returns over time.

Current Opportunities and Threats

Several factors support continued growth potential. First, artificial intelligence adoption is accelerating rapidly. Second, cloud computing migration continues globally. Third, digital transformation remains a priority for businesses.

However, challenges exist as well. Rising interest rates pressure high-multiple stocks. Additionally, increased competition may compress profit margins. Furthermore, regulatory scrutiny continues intensifying across the sector.

The Bottom Line Strategy

This tech-heavy index offers compelling long-term opportunities for patient investors. However, it requires tolerance for volatility and periodic corrections. Therefore, it works best as part of a diversified portfolio.

Moreover, systematic investing approaches tend to outperform timing strategies. Additionally, focusing on long-term trends rather than short-term noise improves results. Finally, regular rebalancing helps capture gains and manage risk effectively.

Remember, successful investing requires discipline, patience, and continuous learning. Therefore, treat this analysis as educational rather than investment advice. Always conduct your own research and consult financial professionals before making investment decisions.

You Might also find this post insightful – https://bosslevelfinance.com/why-atmos-energy-could-shine

Important Disclaimer: This analysis is purely educational. We do not encourage users to buy, sell, or hold any stocks. Markets are subject to risks and can change rapidly. Always do your own due diligence before making investment decisions.

Sources:

- https://www.nasdaq.com/articles/2024-review-and-2025-outlook

- https://www.cnbc.com/quotes/.IXIC

- https://in.investing.com/indices/nasdaq-composite-historical-data

- https://tradingeconomics.com/us100:ind

- https://indexes.nasdaqomx.com/docs/FS_COMP.pdf

- https://www.morningstar.com/news/dow-jones/202507288610/nasdaq-composite-rises-033-to-2117858-16th-record-close-of-2025-data-talk

- https://in.investing.com/indices/nasdaq-composite

- https://www.marketwatch.com/investing/index/comp

- https://tradingeconomics.com/united-states/nasdaq-composite-index-fed-data.html

- https://in.tradingview.com/symbols/NASDAQ-IXIC/

- https://www.nasdaq.com/articles/first-quarter-2025-review-outlook

- https://en.wikipedia.org/wiki/Nasdaq_Composite

- https://www.statista.com/statistics/1104283/weekly-nasdaq-index-performance/

- https://www.nasdaq.com/articles/2024-review-and-2025-outlook

- https://www.cnbc.com/quotes/.IXIC

- https://in.investing.com/indices/nasdaq-composite-historical-data

- https://tradingeconomics.com/us100:ind

- https://indexes.nasdaqomx.com/docs/FS_COMP.pdf

- https://www.morningstar.com/news/dow-jones/202507288610/nasdaq-composite-rises-033-to-2117858-16th-record-close-of-2025-data-talk

- https://in.investing.com/indices/nasdaq-composite

- https://finance.yahoo.com/sectors/technology/

- https://www.marketwatch.com/investing/index/comp

- https://tradingeconomics.com/united-states/nasdaq-composite-index-fed-data.html

- https://in.tradingview.com/symbols/NASDAQ-IXIC/

- https://www.nasdaq.com/market-activity/index/ndxt

- https://www.bloomberg.com/quote/CCMP:IND

- https://www.nasdaq.com/articles/first-quarter-2025-review-outlook

- https://finance.yahoo.com/quote/%5EIXIC/

- https://www.ig.com/en/indices/markets-indices/us-tech-100

- https://en.wikipedia.org/wiki/Nasdaq_Composite

- https://www.statista.com/statistics/1104283/weekly-nasdaq-index-performance/

- https://www.reuters.com/markets/quote/.IXIC/

- https://groww.in/indices/global-indices/nasdaq