This hidden gem Outbrain Inc (OB) just secured a game-changing acquisition while delivering explosive growth that’s making industry titans nervous

The most remarkable turnaround story in digital advertising continues unfolding before our eyes. Moreover, while investors chase overpriced tech darlings and speculative plays, Outbrain Inc delivers the kind of fundamental transformation that creates legendary investment returns. Additionally, the company’s recent mega-acquisition and strategic positioning represent perhaps the greatest value opportunity in today’s market.

Furthermore, smart money recognizes this as the rare combination of deep value meets explosive growth potential. Meanwhile, the company sits perfectly positioned at the intersection of native advertising and connected TV, two of the fastest-growing segments in digital media. Therefore, sophisticated investors should pay close attention to this unfolding opportunity.

The Revolutionary Teads Acquisition: Creating an Industry Powerhouse

Wall Street’s most seasoned analysts scrambled to upgrade their models after the block, Outbrain completed its transformative acquisition of Teads in February 2025 for approximately $900 million. Furthermore, this strategic combination creates one of the largest open internet advertising platforms globally.

However, the true genius lies in the strategic synergies. Moreover, the combined entity now operates under the Teads brand, reaching an incredible 2.2 billion consumers worldwide. Additionally, the merger combines approximately $1.7 billion in advertising spend, creating unprecedented scale advantages.

Meanwhile, the transaction structure demonstrates management’s confidence and strategic vision. Specifically, the deal comprised $625 million in cash plus 43.75 million shares of common stock. Furthermore, expected synergies of $65-75 million annually by 2026 provide substantial value creation opportunities. Therefore, this acquisition represents far more than simple consolidation.

Unprecedented Scale and Competitive Advantages

The new combined platform fundamentally reshapes the competitive landscape. Moreover, the merger unites two of the richest contextual and interest data sets on the open internet. Additionally, this powerful combination feeds an advanced AI prediction engine that optimizes advertiser outcomes across all channels.

Furthermore, the platform now delivers end-to-end solutions from branding to performance across screens including CTV, mobile, and web. Meanwhile, competitors struggle to match this comprehensive offering and unprecedented reach. Therefore, the combined entity has built substantial competitive moats in the advertising technology space.

Specifically, CEO David Kostman emphasized the transformative nature during recent earnings calls. Moreover, he stated that the combination “directly addresses a large gap in the advertising industry: a scaled end-to-end platform that can drive outcomes.” Additionally, early feedback from hundreds of advertisers and media owners has been highly encouraging.

Financial Performance Explosion: Numbers That Demand Attention

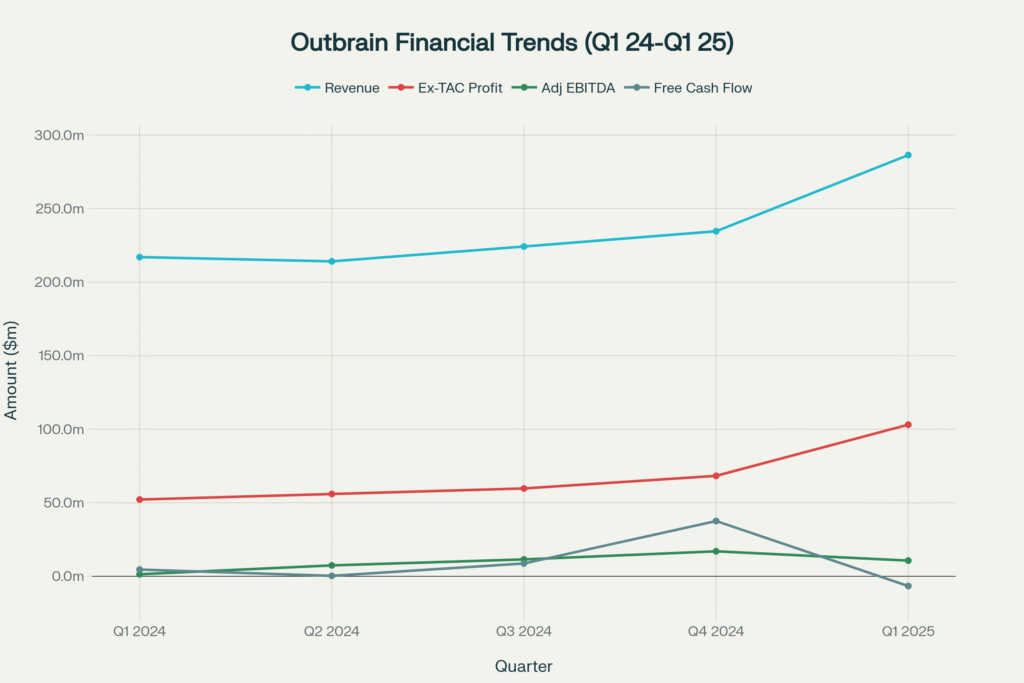

The first quarter 2025 results following the acquisition showcase tremendous momentum. Moreover, revenue surged 32% year-over-year to $286.4 million, substantially outpacing industry growth rates. Additionally, Ex-TAC gross profit exploded 98% to $103.1 million, demonstrating exceptional operating leverage.

Furthermore, Adjusted EBITDA reached $10.7 million, representing a staggering 665% increase from the prior year. Meanwhile, these metrics highlight the company’s ability to generate substantial cash flows during uncertain economic conditions. Therefore, the financial transformation validates management’s strategic execution capabilities.

Outbrain’s quarterly financial performance showing strong revenue growth and improving profitability metrics

However, the most impressive metric involves Connected TV (CTV) revenue growth. Specifically, CTV revenues grew more than 100% year-over-year, now representing approximately 5% of total advertising spend. Moreover, this positions the company perfectly for the ongoing shift from traditional television to streaming platforms. Additionally, CTV represents one of the highest-growth segments in digital advertising.

Meanwhile, gross margin expansion tells the profitability story. Furthermore, gross margins improved dramatically to 28.9% from 19.2% in the prior year. Additionally, Ex-TAC gross margins reached 36.0% compared to 24.0% previously. Therefore, the combination creates substantial operating leverage and margin expansion opportunities.

The Growth Engine: Multiple Drivers Accelerating Performance

Several powerful growth drivers position the company for sustained outperformance. Moreover, the successful launch of “Moments,” their vertical video solution, gained adoption from over 70 publishers. Additionally, this innovation demonstrates the company’s ability to capitalize on emerging content formats and consumer preferences.

Furthermore, brand and agency spending continues accelerating on the platform. Specifically, total direct spend from brand and agency customers exceeded $100 million in recent quarters. Moreover, this represents over 40% of total advertiser spend, highlighting the platform’s appeal to premium clients. Therefore, the company successfully captures share from larger advertising budgets.

Meanwhile, supply partnerships continue expanding beyond traditional feed inventory. Additionally, these partnerships now drive over 25% of total revenue, providing diversification and growth opportunities. Furthermore, the expanded supply base creates more monetization opportunities for publishers while offering advertisers greater reach and targeting capabilities.

Competitive Positioning: Crushing Rivals in the Native Advertising Arms Race

The native advertising landscape reveals a fascinating competitive dynamic between industry titans. Moreover, while Taboola maintains broader market share across some segments, recent developments show shifting momentum. Additionally, user reviews and industry comparisons highlight distinct competitive advantages for each platform.

Furthermore, both companies offer similar core services, but differentiation emerges in execution quality and publisher relationships. Specifically, industry feedback suggests higher quality publishing partners and better content grouping capabilities. Moreover, the platform provides more editorial guidelines and potential impressions compared to competitors.

However, the recent Teads acquisition fundamentally alters the competitive equation. Meanwhile, competitors lack the comprehensive video and display capabilities that the combined entity now offers. Additionally, the expanded contextual and audience data sets provide superior targeting capabilities. Therefore, the competitive positioning has strengthened dramatically following the strategic combination.

Market Share Dynamics and Strategic Advantages

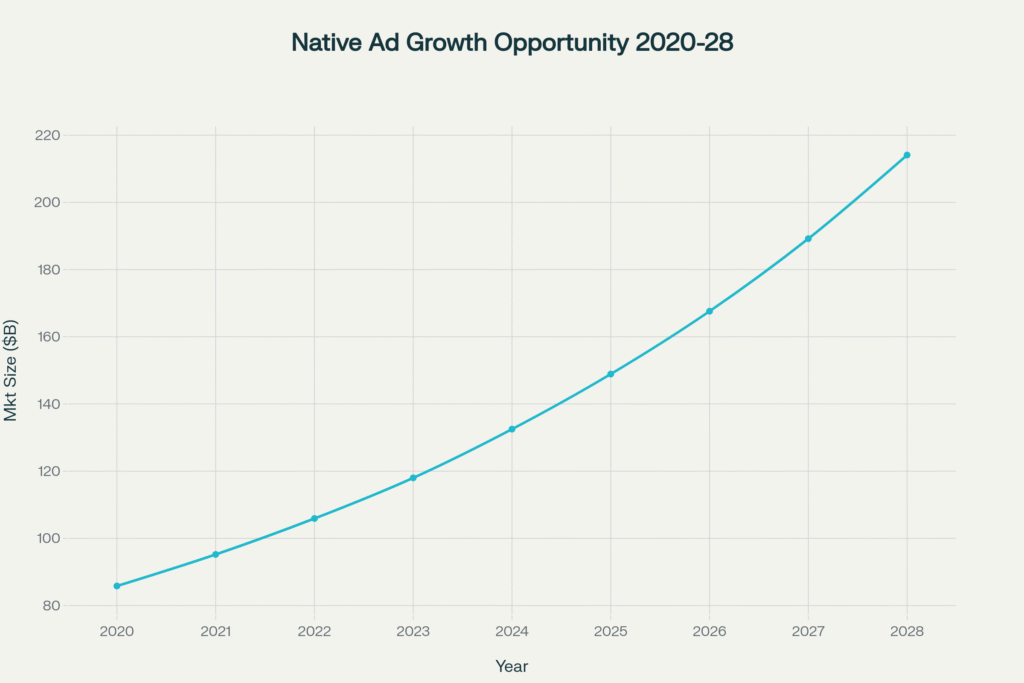

The broader market context reveals substantial growth opportunities across the native advertising sector. Moreover, the global native advertising market reached $105.88 billion in 2024 and projects growth to $346.88 billion by 2033. Additionally, this represents a compound annual growth rate of 13.9%, providing substantial tailwinds for well-positioned companies.

Native advertising market projected to grow from $132.5B in 2024 to $214.1B by 2028, representing massive opportunity

Furthermore, key industry trends favor platforms with strong programmatic capabilities and mobile optimization. Specifically, programmatic native advertising continues gaining traction as marketers seek automated, scalable delivery solutions. Moreover, the shift toward privacy-compliant advertising creates opportunities for contextual targeting specialists. Therefore, companies with rich first-party data assets maintain significant competitive advantages.

Meanwhile, retail media networks drive incremental demand growth across the sector. Additionally, aggregate retail media revenue surpasses $176.9 billion in 2025, creating new monetization opportunities. Furthermore, these networks deliver exceptional returns on advertising spend, attracting incremental budgets rather than cannibalizing existing spend. Therefore, the total addressable market continues expanding rapidly.

Wall Street’s Verdict: Analysts See Massive Upside Potential

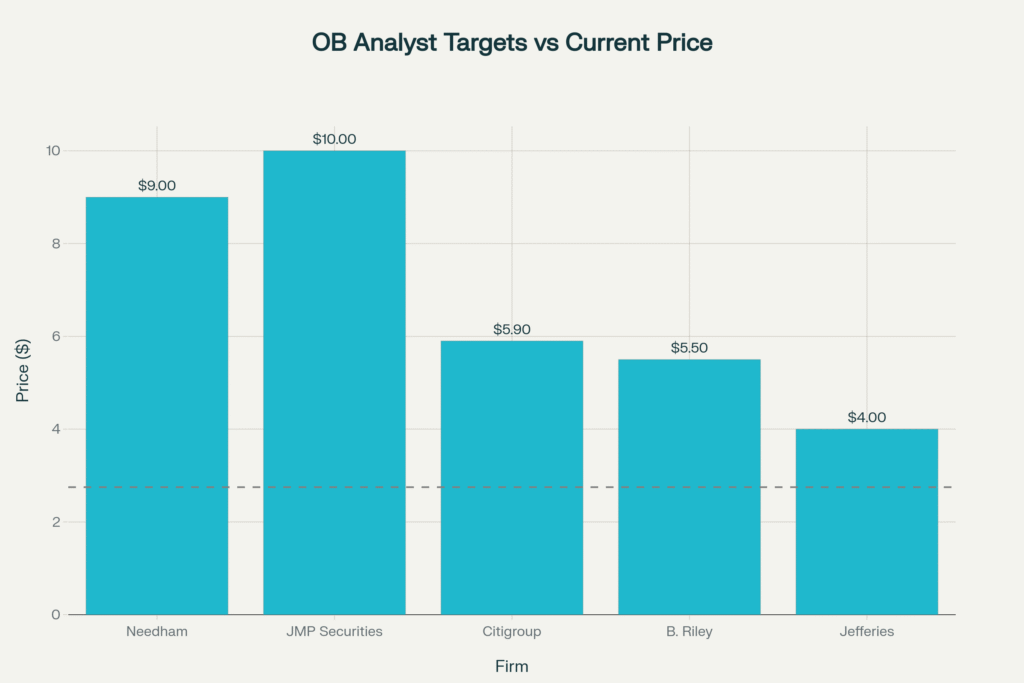

The professional investment community demonstrates remarkable consensus regarding the company’s prospects. Moreover, analyst coverage includes prominent firms like Needham, JMP Securities, Citigroup, and B. Riley Securities. Additionally, recent analyst actions show predominantly positive revisions and upgraded price targets following the Teads acquisition.

Analyst price targets show significant upside potential compared to current trading levels

Furthermore, the average analyst price target reaches approximately $7.95, implying substantial upside from current trading levels. Specifically, price targets range from $4.00 to $10.00, with the highest targets suggesting potential returns exceeding 260%. Moreover, recent upgrades from major firms signal growing institutional confidence in the transformation story.

Meanwhile, Laura Martin from Needham maintains a Buy rating with a $9.00 price target. Additionally, JMP Securities raised their target to $10.00 with a Market Outperform rating. Furthermore, even neutral-rated analysts acknowledge significant upside potential from current valuation levels. Therefore, the analyst community recognizes substantial value creation opportunities ahead.

Valuation Disconnect Creates Contrarian Opportunity

The current valuation metrics reveal a compelling contrarian investment opportunity. Moreover, the stock trades at historically low multiples despite improving fundamentals and strategic positioning. Additionally, the market appears to undervalue the synergies and growth potential from the Teads combination.

Furthermore, enterprise value to revenue multiples remain well below historical averages and peer comparisons. Meanwhile, the dramatic improvement in margins and cash generation suggests substantial earnings power expansion. Additionally, the company’s focus on profitable growth rather than speculative ventures provides downside protection during market volatility.

Meanwhile, technical indicators suggest the stock has established a solid base after recent correction. Moreover, key support levels around $2.50 provide attractive risk-reward parameters for patient investors. Additionally, any improvement in market sentiment toward advertising technology stocks could drive significant multiple expansion. Therefore, risk-managed investors can establish positions with clear stop-loss levels.

Growth Catalysts: Multiple Drivers Align for Exceptional Returns

Several powerful catalysts position the company for sustained outperformance through 2025 and beyond. Moreover, the integration of Teads operations provides immediate revenue and margin benefits. Additionally, the realization of $65-75 million in annual synergies creates substantial value creation opportunities over the next two years.

Furthermore, the continued expansion of Connected TV advertising represents a massive long-term opportunity. Specifically, CTV ad spending continues growing at double-digit rates as streaming adoption accelerates. Moreover, the combined platform now offers comprehensive video advertising solutions across all screens and formats. Therefore, the company participates directly in one of the fastest-growing segments of digital advertising.

Meanwhile, the “Moments” vertical video solution demonstrates the company’s innovation capabilities and market responsiveness. Additionally, adoption by over 70 publishers validates the product-market fit and revenue potential. Furthermore, this positions the company to capitalize on the continued shift toward short-form video content consumption. Therefore, innovation pipeline provides multiple growth vectors beyond core advertising operations.

International Expansion and Market Development

Geographic expansion presents substantial long-term growth opportunities across multiple regions. Moreover, the combined entity now has enhanced presence in Europe, Asia-Pacific, and North American markets. Additionally, international markets often exhibit higher growth rates and less competitive intensity compared to mature U.S. markets.

Furthermore, local partnerships and publisher relationships provide sustainable competitive advantages in regional markets. Meanwhile, the platform’s AI-driven optimization and contextual targeting capabilities translate effectively across different languages and cultural contexts. Additionally, international expansion provides natural diversification benefits and multiple growth vectors. Therefore, geographic expansion amplifies the overall growth opportunity.

Risk Assessment: Understanding the Investment Challenges

Sophisticated investors recognize that exceptional opportunities often involve meaningful risks requiring careful consideration. Moreover, the advertising technology sector faces ongoing challenges from economic volatility and changing privacy regulations. Additionally, integration risks from the Teads acquisition could temporarily impact operational efficiency and financial performance.

Furthermore, competitive pressures from larger technology platforms continue intensifying across all digital advertising segments. Meanwhile, companies like Google, Facebook, and Amazon command substantial market share and resources. Additionally, any adverse changes in publisher relationships or advertiser demand could significantly impact revenues. Therefore, investors should understand these industry dynamics and competitive challenges.

Meanwhile, macroeconomic headwinds affecting advertising spending could pressure near-term results. Furthermore, the company’s debt levels increased following the Teads acquisition, creating refinancing risks if credit conditions tighten. Additionally, achieving projected synergies requires successful integration and operational execution. Therefore, investment success depends on management’s ability to execute the integration plan effectively.

Regulatory and Technology Disruption Risks

The evolving regulatory landscape presents both challenges and opportunities across the advertising technology sector. Moreover, privacy regulations like GDPR and CCPA continue expanding globally, requiring ongoing technology investments and compliance measures. Additionally, the deprecation of third-party cookies necessitates new targeting and measurement approaches.

However, the company’s focus on contextual advertising and first-party data positions it well for these regulatory changes. Furthermore, the platform’s native advertising format inherently provides better user experiences compared to traditional display advertising. Meanwhile, the rich contextual and interest data sets provide sustainable competitive advantages in a privacy-focused environment. Therefore, regulatory changes may actually strengthen the company’s competitive position relative to behavioral targeting specialists.

The Investment Thesis: A Generational Value Creation Opportunity

The confluence of multiple positive factors creates a compelling investment opportunity for patient, sophisticated investors. Moreover, the combination of attractive valuation, strategic positioning, and multiple growth catalysts rarely aligns so favorably. Additionally, the company’s transformation from struggling independent player to industry powerhouse represents classic value creation through strategic consolidation.

Furthermore, the native advertising market’s projected growth provides substantial tailwinds for well-positioned companies. Meanwhile, the shift toward privacy-compliant, contextual advertising favors platforms with rich first-party data assets. Additionally, the expansion into Connected TV advertising positions the company for participation in one of the fastest-growing segments of digital media.

Therefore, investors seeking exposure to digital advertising growth while maintaining attractive risk-adjusted returns should strongly consider this opportunity. Moreover, the current valuation disconnect provides exceptional entry points for long-term wealth creation. Additionally, the multiple catalysts ahead suggest sustained outperformance potential through 2025 and beyond.

You Might also find this post insightful – https://bosslevelfinance.com/gm-s-unstoppable-comeback-crushing-tesla-while-wall-street-sleeps

Sources and References:

Outbrain Inc. Official Earnings Reports and SEC Filings

Globe Newswire Press Releases and Company Announcements

Needham & Company Analyst Research Reports

JMP Securities and B. Riley Securities Analyst Coverage

Citigroup and Jefferies Financial Analysis

Yahoo Finance and MarketBeat Market Data

TradingView Technical Analysis Platform

Morningstar Investment Research Database

Native Advertising Industry Reports and Market Research

Various Financial News Sources and Industry Publications

- https://www.valueresearchonline.com/stocks/292977/outbrain-inc-ob/

- https://markets.businessinsider.com/news/stocks/outbrain-announces-third-quarter-2024-results-1033969264

- https://anachart.com/ticker/ob/

- https://in.tradingview.com/symbols/NASDAQ-OB/

- https://www.gurufocus.com/news/2718766/outbrain-inc-reports-q4-2024-revenue-of-2346-million-missing-estimates-net-loss-of-02-million-amid-strategic-profitability-focus

- https://simplywall.st/stocks/my/food-beverage-tobacco/klse-obhb/ob-holdings-berhad-shares

- https://appreciatewealth.com/us-stocks/outbrain-inc-share-price

- https://markets.ft.com/data/announce/full?dockey=1330-9114176en-11GDN7FC1NN3CFT3FBHA785DMP

- https://simplywall.st/stocks/my/food-beverage-tobacco/klse-obhb/ob-holdings-berhad-shares/valuation

- https://www.morningstar.com/stocks/xnas/ob/quote

- https://www.finanznachrichten.de/nachrichten-2025-02/64683538-outbrain-inc-outbrain-announces-fourth-quarter-and-full-year-2024-results-399.htm

- https://www.tipranks.com/stocks/ob/forecast

- https://www.marketscreener.com/quote/stock/OUTBRAIN-INC-125090822/

- https://www.globenewswire.com/news-release/2025/02/27/3033654/0/en/Outbrain-Announces-Fourth-Quarter-and-Full-Year-2024-Results.html

- https://intellectia.ai/stock/OB

- https://www.gurufocus.com/stock/OB/summary

- https://www.globenewswire.com/fr/news-release/2024/05/09/2878550/0/en/Outbrain-Announces-First-Quarter-2024-Results.html

- https://www.barchart.com/stocks/quotes/OB/technical-analysis

- https://www.indmoney.com/us-stocks/outbrain-inc-share-price-ob

- https://markets.ft.com/data/announce/detail?dockey=1330-9201269en-5HAN368READ0MUUR40AE1ISN55

- https://vizologi.com/business-strategy-canvas/outbrain-business-model-canvas/

- https://www.cravath.com/news-insights/outbrains-acquisition-of-teads.html

- https://www.themediaant.com/blog/native-advertising-trends-2025/

- https://www.outbrain.com/blog/outbrain-advertising-what-it-is-and-how-it-works/

- https://www.exchangewire.com/blog/2025/02/04/outbrain-completes-the-acquisition-of-teads/

- https://roiminds.com/native-advertising-trends-to-watch-out/

- https://www.outbrain.com/resources/outbrain-ads/grow-your-business-with-outbrain-advertising-platform/

- https://advanced-television.com/2025/02/03/outbrain-teads-close-merger/

- https://www.readpeak.com/articles/news/how-consumer-behavior-is-shaping-native-advertising-as-we-move-into-2025

- https://www.outbrain.com

- https://www.finanznachrichten.de/nachrichten-2025-02/64449801-outbrain-inc-outbrain-completes-the-acquisition-of-teads-399.htm

- https://www.prnewswire.com/news-releases/global-native-advertising-market-set-to-be-worth-over-400bn-by-2025-300805997.html

- https://www.businessofapps.com/ads/outbrain/

- https://markets.ft.com/data/announce/detail?dockey=1330-9351846en-7N2PJSK1JRQ4VKAPN7JPFT9BLL

- https://www.mordorintelligence.com/industry-reports/native-advertising-market

- https://pitchgrade.com/companies/outbrain-inc

- https://markets.ft.com/data/announce/full?dockey=1330-9351846en-7N2PJSK1JRQ4VKAPN7JPFT9BLL

- https://www.grandviewresearch.com/industry-analysis/native-advertising-market-report

- https://www.hostingadvice.com/blog/outbrain-gets-to-the-heart-of-online-advertising/

- https://www.lenzstaehelin.com/news-and-insights/browse-deals-and-cases/dealscases-detail/outbrains-acquisition-of-teads/

- https://in.investing.com/equities/outbrain-technical?timeFrame=3600

- https://public.com/stocks/ob/pe-ratio

- https://omr.com/en/reviews/vs/outbrain-versus-taboola

- https://www.fidelity.com/learning-center/trading-investing/fundamental-analysis/company-valuation-ratios

- https://omr.com/en/reviews/vs/taboola-versus-outbrain

- https://csimarket.com/stocks/OB-technical-analysis

- https://www.trustradius.com/compare-products/outbrain-vs-taboola

- https://www.bajajfinserv.in/what-is-pe-ratio

- https://www.similartech.com/compare/outbrain-publisher-vs-taboola

- https://altindex.com/ticker/ob/technical-analysis

- https://groww.in/p/pe-ratio

- https://www.brax.io/blog/outbrain-competitors

- https://www.investing.com/equities/outbrain-technical

- https://www.investopedia.com/articles/fundamental-analysis/09/five-must-have-metrics-value-investors.asp

- https://adsjumbo.com/blog/outbrain-vs-taboola-compare-outbrain-vs-taboola

- https://www.tradingview.com/symbols/NASDAQ-OB/technicals/

- https://www.investopedia.com/terms/p/price-earningsratio.asp

- https://www.marketbeat.com/stocks/NASDAQ/OB/forecast/

- https://www.globenewswire.com/news-release/2025/05/09/3078072/0/en/Outbrain-Announces-First-Quarter-2025-Results.html

- https://in.investing.com/news/transcripts/earnings-call-transcript-outbrains-q1-2025-results-show-mixed-signals-93CH-4822041

- https://www.benzinga.com/insights/analyst-ratings/24/05/38582814/evaluating-outbrain-insights-from-4-financial-analysts

- https://www.insidermonkey.com/blog/outbrain-inc-nasdaqob-q4-2024-earnings-call-transcript-1470010/

- https://www.investing.com/news/transcripts/earnings-call-transcript-outbrains-q1-2025-results-show-mixed-signals-93CH-4036590

- https://www.benzinga.com/insights/analyst-ratings/24/09/40898479/5-analysts-have-this-to-say-about-outbrain

- https://seekingalpha.com/article/4784565-outbrain-inc-ob-q1-2025-earnings-call-transcript

- https://www.gurufocus.com/news/2843389/outbrain-inc-ob-q1-2025-everything-you-need-to-know-ahead-of-earnings

- https://www.benzinga.com/insights/analyst-ratings/25/01/43097200/beyond-the-numbers-4-analysts-discuss-outbrain-stock

- https://seekingalpha.com/article/4763373-outbrain-inc-ob-q4-2024-earnings-call-transcript

- https://www.gurufocus.com/news/2848969/outbrain-inc-ob-q1-2025-earnings-revenue-surpasses-estimates-at-2864-million-net-loss-widens-to-548-million?r=4bf001661e6fdd88d0cd7a5659ff9748&mod=mw_quote_news

- https://www.benzinga.com/quote/OB/analyst-ratings?adType=benzinga-insights&ad=analyst-ratings

- https://in.investing.com/news/earnings-call-outbrain-projects-robust-growth-and-strategic-expansion-93CH-4051193

- https://seekingalpha.com/pr/20098198-outbrain-announces-first-quarter-2025-results

- https://in.benzinga.com/insights/analyst-ratings/25/03/44445425/a-glimpse-into-the-expert-outlook-on-outbrain-through-7-analysts

- https://www.insidermonkey.com/blog/outbrain-inc-nasdaqob-q1-2025-earnings-call-transcript-1530335/

- https://www.stocktitan.net/news/OB/outbrain-announces-first-quarter-2025-aiwyuev16lmw.html

- https://www.benzinga.com/insights/analyst-ratings/24/08/40135674/a-glimpse-into-the-expert-outlook-on-outbrain-through-5-analysts

- https://investors.outbrain.com/news-releases/news-release-details/outbrain-announces-third-quarter-2023-results