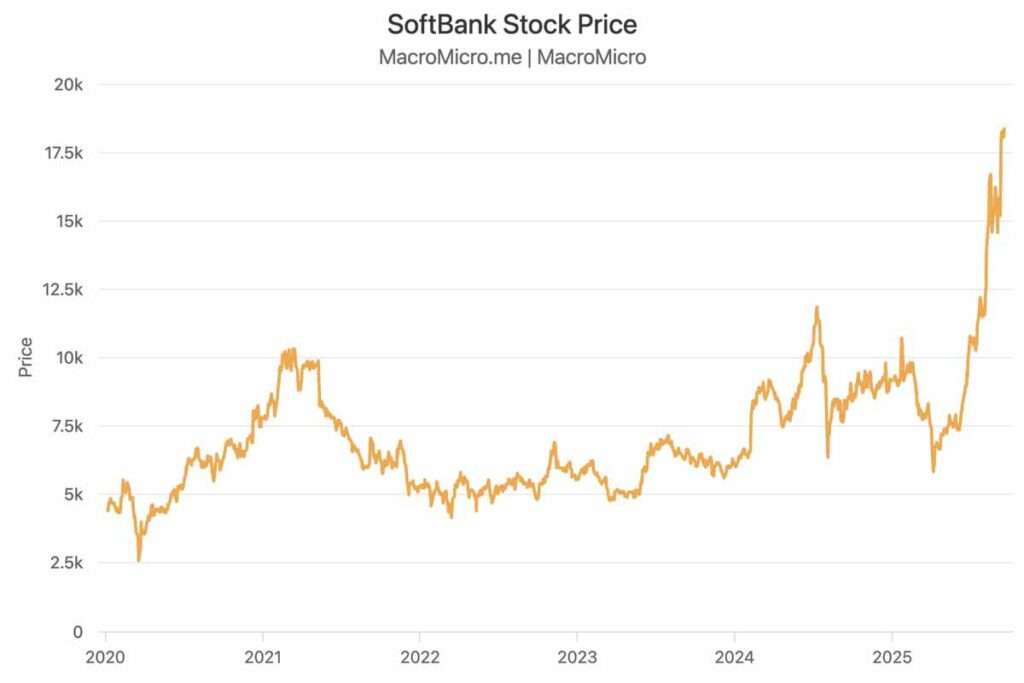

SoftBank Group is experiencing a powerful resurgence in 2025. Moreover, the Japanese investment giant reported a record-breaking net income of ¥2.9 trillion in the second quarter. Furthermore, this represents a stunning 94% increase in market capitalization over just one year. Additionally, CEO Masayoshi Son is making aggressive investments in artificial intelligence infrastructure. In fact, the company has committed $40 billion to OpenAI and acquired ABB’s robotics division for $5.4 billion. However, these moves come after years of turbulence in the Vision Fund portfolio.

Why SoftBank Is Betting Billions on AI

Masayoshi Son has always been a visionary investor. In addition, his track record includes the legendary $20 million Alibaba investment that turned into $58 billion. Now, he’s betting heavily on what he calls the “AI Singularity” – the moment when artificial intelligence surpasses human intelligence.

Currently, the company is restructuring its entire portfolio around this vision. Specifically, Son sold SoftBank’s entire $5.8 billion Nvidia stake in October 2025. Similarly, the firm offloaded $9.1 billion worth of T-Mobile shares. Consequently, these sales generated massive liquidity to fund AI investments.

Furthermore, the investment strategy focuses on “Physical AI” – connecting intelligence with embodiment through robots, data centers, and cloud systems. Therefore, this approach differs from previous Vision Fund investments in software companies.

SoftBank Financial Performance: Record Profits Signal Turning Point

The financial turnaround has been remarkable. Nevertheless, let’s examine the numbers closely.

For fiscal year 2024, revenue reached ¥6.54 trillion, representing a 7.6% year-over-year increase. Meanwhile, operating income jumped 12.9% to ¥989 billion. Importantly, net income attributable to shareholders grew to ¥526.1 billion.

However, the real excitement came in the first half of fiscal 2025. During this period, the company posted net income of ¥2.9 trillion – nearly six times the previous year’s result. Specifically, investment gains from OpenAI contributed ¥2.16 trillion to this figure.

Additionally, all business segments showed growth. The Consumer segment increased profitability through higher smartphone subscribers. Similarly, the Enterprise segment saw an 8% increase in underlying income. Most notably, the Financial segment turned profitable for the first time, driven by PayPay’s rapid expansion.

Understanding the Vision Fund Turnaround Story of SoftBank

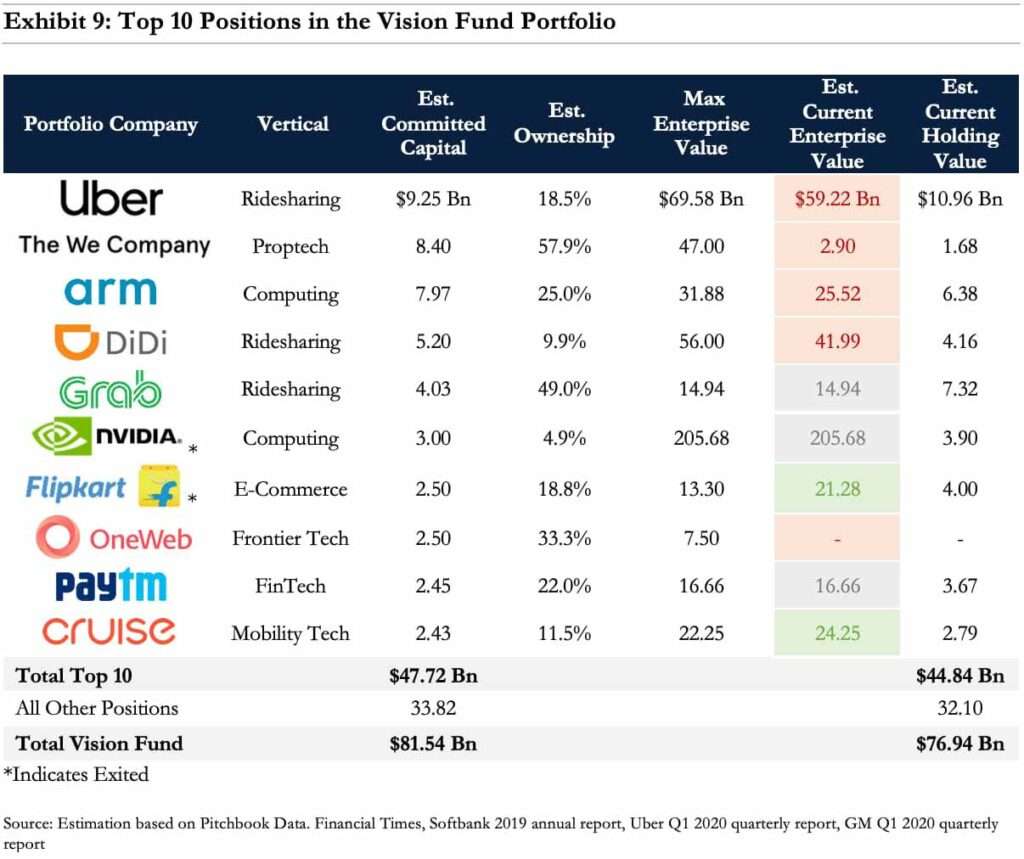

The Vision Fund has experienced dramatic swings. Initially, it posted a record loss of ¥3.2 trillion in fiscal 2022. Consequently, Masayoshi Son publicly stated he felt “embarrassed” by the performance.

Yet, the situation has improved significantly. In fiscal 2024, the Vision Fund reduced losses to just ¥115 billion. Then, in the first quarter of fiscal 2025, it generated a gain of ¥451 billion. Most impressively, the second quarter saw a massive gain of ¥3,415 billion.

These gains came from multiple sources. First, ByteDance’s valuation increased substantially. Second, investments in Indian companies like Swiggy and Grab performed well. Third, the OpenAI investment alone generated nearly ¥2 trillion in gains.

Nevertheless, challenges remain. Portfolio companies like AutoStore experienced valuation declines. Furthermore, the overall performance depends heavily on volatile public market valuations.

Breaking Down the Balance Sheet and Debt Position

Understanding financial health requires examining the capital structure. Currently, the debt-to-equity ratio stands at 1.78, which is notably above the industry average of 1.1.

Total debt amounts to approximately ¥6.5 trillion. Meanwhile, shareholder equity totals ¥4.5 trillion. Therefore, the company uses leverage more aggressively than peers.

However, this strategy isn’t necessarily negative. In fact, the interest coverage ratio of 20x demonstrates strong ability to service debt. Additionally, cash and short-term investments total ¥1.5 trillion, providing substantial liquidity.

Moreover, SoftBank has been actively managing its debt. Recently, the company secured a $20 billion margin loan backed by Arm Holdings shares. Of this amount, $11.5 billion remains undrawn, providing future flexibility.

Analyzing Valuation Metrics: Is SoftBank Fairly Priced?

Current market capitalization stands at approximately ¥28.5 trillion ($167 billion). Furthermore, the stock price has surged from a 52-week low of $19.86 to recent highs near $90.

The P/E ratio of 8.13 appears quite attractive. In comparison, this is below both the wireless industry average and broader market multiples. Therefore, on a traditional valuation basis, the stock doesn’t appear overvalued.

However, some analysts argue differently. Discounted cash flow models suggest a fair value around ¥6,987 per share – significantly below the current price of ¥22,605. Consequently, this implies the market is pricing in substantial future growth.

Nevertheless, valuation becomes complex with holding companies. The Net Asset Value (NAV) provides a better framework. As of September 2025, NAV totaled ¥33.31 trillion. This translates to approximately ¥23,000 per share, which is close to the current market price.

Strategic Asset Portfolio: Where Does Value Lie?

The equity value of holdings totals ¥39.87 trillion. Let’s break down the major components.

Arm Holdings represents the crown jewel. Currently valued at ¥18.18 trillion in the portfolio, SoftBank owns approximately 87% of this chip designer. Importantly, Arm’s share price has rallied 38% this year, driven by AI chip demand.

Vision Fund 1 holds equity value of ¥3.96 trillion. Since inception, this fund has generated gross gains of $32.8 billion despite recent volatility.

Vision Fund 2 accounts for ¥8.26 trillion. Although this fund has cumulative losses of $9.1 billion since inception, recent performance has improved dramatically.

OpenAI Investment has become increasingly significant. The company’s stake has grown to approximately 11% after committing up to $40 billion. At OpenAI’s $300 billion valuation, this stake alone is worth roughly $33 billion.

Other Holdings include stakes in Deutsche Telekom (¥50 billion) and various domestic businesses. The SoftBank Corp telecommunications subsidiary contributes ¥3.37 trillion in adjusted equity value.

Key Risks Every Investor Should Consider

Despite the impressive turnaround, several risks warrant attention. First, the heavy concentration in AI creates sector-specific risk. If the AI boom slows, valuations could decline rapidly.

Second, the high debt-to-equity ratio limits financial flexibility. Although currently manageable, economic downturns could strain the balance sheet. Additionally, margin loans backed by Arm shares create potential forced-selling scenarios if valuations drop.

Third, regulatory risks affect multiple portfolio companies. OpenAI faces increasing scrutiny regarding AI safety and copyright issues. Similarly, Chinese investments like ByteDance encounter geopolitical tensions.

Fourth, execution risk remains with the Stargate project. This $500 billion AI infrastructure initiative requires massive capital deployment. Furthermore, coordinating with multiple partners adds complexity.

Finally, valuation risk concerns arise. Many AI companies trade at unprecedented multiples. Therefore, if market sentiment shifts, portfolio values could compress quickly.

What the Numbers Tell Us About Investment Strategy

The recent asset sales reveal strategic priorities. Selling Nvidia – despite its strong performance – demonstrates disciplined capital allocation. Instead of holding a passive investment, Son is deploying capital into businesses where he has influence.

This approach aligns with his historical playbook. The early Alibaba investment succeeded partly because SoftBank provided strategic support. Similarly, the OpenAI investment comes with board representation and strategic initiatives.

The Stargate project exemplifies this strategy. Rather than simply investing in AI companies, SoftBank is building infrastructure. Consequently, this creates competitive advantages and potential monopolistic positions in data center capacity.

Moreover, the focus on “Physical AI” creates tangible assets. Unlike pure software investments, robotics and data centers have real-world value that’s easier to assess.

Future Outlook: What’s Next for SoftBank?

Looking ahead, several developments will shape performance. First, the Stargate project’s execution will be critical. The first data centers should begin operations in Texas soon. Success here could validate the entire AI infrastructure thesis.

Second, OpenAI’s trajectory matters enormously. The company’s roadmap toward artificial general intelligence (AGI) drives valuation. Additionally, commercial success with enterprise products like Cristal intelligence will generate revenue.

Third, the robotics division acquired from ABB needs integration. This $5.4 billion bet represents a major commitment to Physical AI. Therefore, successfully commercializing these technologies is essential.

Fourth, the broader market environment for tech stocks will influence valuations. If interest rates remain elevated, high-growth valuations may face pressure. Conversely, continued AI enthusiasm could drive further gains.

Finally, Son’s age (68) raises succession questions. His personal vision drives much of the strategy. Therefore, long-term investors should consider leadership transition risks.

Making Sense of the Investment Opportunity

SoftBank stock represents a leveraged bet on the AI revolution. The company has pivoted decisively from its Vision Fund struggles toward infrastructure investments. Furthermore, recent financial results demonstrate this strategy is generating substantial returns.

However, the investment comes with significant volatility and risk. The debt level, concentration in AI, and dependence on visionary leadership create potential downsides. Additionally, current valuations price in substantial future success.

For investors comfortable with these risks, the opportunity appears compelling. The P/E ratio of 8.13 is attractive relative to growth prospects. Moreover, the NAV provides downside support near current levels. Most importantly, Son’s track record of identifying transformative technologies deserves respect.

Nevertheless, this isn’t a conservative investment. Rather, it’s a bold bet that AI infrastructure will generate returns justifying current valuations. Therefore, position sizing should reflect individual risk tolerance.

👉 You Might also find this post insightful – https://bosslevelfinance.com/the-truth-about-meta-s-huge-ai-bet

Important Disclaimer

This analysis is for informational and educational purposes only. We do not encourage or recommend buying, selling, or holding any securities. Stock markets are subject to risk and volatility. Past performance does not guarantee future results. Always conduct your own due diligence and consult with a qualified financial advisor before making investment decisions. Investment decisions should be based on your individual financial situation, goals, and risk tolerance.

👇REFERRAL LINKS👇

👉Referral link for Groww – https://app.groww.in/v3cO/dqzy2ejb

👉Referral link for Zerodha – https://zerodha.com/open-account?c=HWR050

👉Referral link for Vested (For investing in US market) – https://refer.vestedfinance.com/RUKU88007

Sources

- SoftBank Corp. Integrated Report 2025 – https://softbank.jp

- SoftBank Vision Fund Annual Loss Report – https://cnbctv18.com

- SoftBank Group Financial Analysis – https://timesofindia.indiatimes.com

- SoftBank Operating Results Full Year – https://softbank.jp

- SoftBank Vision Fund Best Performance Report – https://cnbc.com

- Why SoftBank Sold Nvidia Stake – https://finshots.in

- SoftBank Consolidated Financial Report – https://group.softbank

- SoftBank Vision Fund Activity Analysis – https://news.crunchbase.com

- SoftBank Group Wikipedia – https://en.wikipedia.org

- SoftBank Vision Fund Wikipedia – https://en.wikipedia.org

- SoftBank Stock Price History – https://in.investing.com

- SoftBank Market Cap Analysis – https://stockanalysis.com

- SoftBank Nvidia Sale Report – https://fortune.com

- Arm Holdings Overview – https://en.wikipedia.org

- SoftBank Balance Sheet Health – https://simplywall.st

- SoftBank T-Mobile Sale – https://bloomberg.com

- SoftBank Debt Analysis – https://dcfmodeling.com

- SoftBank Asset Sales – https://ibtimes.co.uk

- SoftBank Arm Margin Loan – https://moneycontrol.com

- SoftBank Earnings Q2 2025 – https://in.investing.com

- https://www.softbank.jp/en/sbnews/entry/20251104_01

- https://www.cnbctv18.com/business/softbank-vision-funds-40-percent-loss-despite-return-to-profit-ws-l-19603862.htm

- https://timesofindia.indiatimes.com/technology/tech-news/softbank-does-exactly-what-nvidia-ceo-jensen-huang-had-made-fun-of-founder-masayoshi-son/articleshow/125246071.cms

- https://www.softbank.jp/en/corp/ir/financials/analytics/

- https://www.cnbc.com/2025/08/07/softbank-vision-fund-posts-4point8-billion-gain-to-drive-quarterly-profit.html

- https://finshots.in/archive/why-softbank-sold-its-golden-goose/

- https://group.softbank/media/Project/sbg/sbg/pdf/ir/financials/financial_reports/financial-report_q2fy2025_01_en.pdf

- https://news.crunchbase.com/venture/softbank-vision-fund-bounces-back-ai-biotech-cyber-quantum/

- https://www.valueresearchonline.com/stories/222701/masayoshi-son-softbank-and-the-pursuit-of-audacious-dreams/

- https://en.wikipedia.org/wiki/SoftBank_Group

- https://en.wikipedia.org/wiki/SoftBank_Vision_Fund

- https://www.forbes.com/profile/masayoshi-son/

- https://group.softbank/en/ir/financials/financial_reports

- https://visionfund.com/portfolio

- https://hbr.org/2025/01/8-lessons-from-the-career-of-softbanks-masayoshi-son

- https://www.softbank.jp/en/corp/ir/documents/financial_reports/

- https://visionfund.com

- https://group.softbank/en/philosophy/strategy

- https://in.investing.com/news/transcripts/earnings-call-transcript-softbanks-q2-2025-sees-record-income-ai-investments-soar-93CH-5099622

- https://group.softbank/en/ir/financials/highlights

- https://in.investing.com/equities/softbank-corp.-historical-data

- https://stockanalysis.com/quote/otc/SFTBY/market-cap/

- https://robinhood.com/stocks/SFTBY

- https://companiesmarketcap.com/inr/softbank/marketcap/

- https://www.bloomberg.com/news/articles/2025-08-14/masayoshi-son-s-fortune-jumps-9-billion-in-two-weeks-on-ai-bets

- https://in.investing.com/equities/softbank-corp-historical-data

- https://group.softbank/en/ir/financials/annual_reports/2025/message/son

- https://tradingeconomics.com/9984:jp:market-capitalization

- https://group.softbank/en/ir/stock/sotp

- https://www.digitimes.com/news/a20251118PD219/chairman-investment-openai-infrastructure-nvidia.html

- https://finance.yahoo.com/quote/9984.T/history/

- https://capital.com/en-int/markets/shares/softbank-group-corp-share-price/market-cap

- https://fortune.com/2025/11/11/softbank-nvidia-openai-masayoshi-son-sam-altman-investment/

- https://group.softbank/en/ir/stock/price

- https://in.investing.com/pro/TSE:9984/explorer/marketcap

- https://www.cnbc.com/2025/11/11/softbank-sells-its-entire-stake-in-nvidia-for-5point83-billion.html

- https://finance.yahoo.com/quote/SFTBY/

- https://www.forbes.com/sites/siladityaray/2025/11/12/masayoshi-son-no-longer-asias-3rd-richest-after-softbank-sells-nvidia-stake/

- https://en.wikipedia.org/wiki/Arm_Holdings

- https://simplywall.st/stocks/us/telecom/otc-sobk.y/softbank/health

- https://www.bloomberg.com/news/articles/2025-06-16/softbank-seeks-to-raise-4-9-billion-in-t-mobile-share-sale-mbzn3ujs

- https://finance.yahoo.com/news/softbank-5b-arm-backed-loan-230525517.html

- https://dcfmodeling.com/blogs/health/9434t-financial-health

- https://www.ibtimes.co.uk/softbank-offloads-nvidia-stake-58b-trims-t-mobile-holdings-fund-225b-openai-investment-1754318

- https://www.moneycontrol.com/artificial-intelligence/softbank-in-talks-for-5-billion-margin-loan-backed-by-arm-stock-article-13608567.html

- https://mlq.ai/stocks/SFTBF/debt-equity-ratio/

- https://group.softbank/media/Project/sbg/sbg/pdf/ir/presentations/2025/investor-finance_q1fy2025_01_en.pdf

- https://economictimes.com/tech/technology/softbank-in-talks-for-5-billion-margin-loan-backed-by-arm-stock-bloomberg/articleshow/124444703.cms

- https://ycharts.com/companies/SFTBY/debt_equity_ratio

- https://www.bloomberg.com/news/articles/2025-10-10/softbank-in-talks-for-5-billion-margin-loan-backed-by-arm-stock

- https://www.gurufocus.com/term/debt-to-equity/TSE:9434

- https://www.reuters.com/business/media-telecom/softbanks-58-billion-nvidia-stake-sale-stirs-fresh-ai-bubble-fears-2025-11-11/

- https://mlq.ai/stocks/9434.T/debt-equity-ratio/

- https://yourstory.com/ai-story/softbank-sells-entire-nvidia-stake-ai-openai

- https://finance.yahoo.com/quote/SFTBF/key-statistics/