Smart money often finds opportunities where others see only problems. Moreover, the aerospace sector has witnessed dramatic transformations recently. Additionally, Rolls-Royce stands out among value investors. Furthermore, this turnaround story continues capturing attention worldwide.

This aerospace giant has delivered stunning returns over recent years. Similarly, operational improvements show consistent progress. Therefore, understanding these fundamentals becomes crucial for informed decisions.

Stunning Performance Shows Recovery Power

Recent price action tells an incredible transformation story. Moreover, shares have surged over 250% in just one year. Additionally, the stock reached highs near £11.12 from lows around £2.92. Furthermore, this represents one of the strongest recoveries in aerospace history.

The company’s market capitalization now approaches £88 billion. Similarly, revenue has grown consistently across multiple quarters. Consequently, investor confidence continues building momentum. Therefore, examining underlying drivers becomes essential.

Technical indicators suggest strong institutional accumulation patterns. Additionally, volume patterns confirm growing smart money interest. Moreover, analyst upgrades reflect improving sentiment. Furthermore, multiple catalysts support continued strength.

Financial Transformation Creates Investment Appeal

Revenue growth demonstrates remarkable consistency in recent periods. Moreover, the company reported £18.9 billion in annual revenue. Additionally, this represents 14.7% year-over-year growth. Furthermore, profit margins continue expanding steadily.

Net income reached £2.5 billion, showing substantial profitability improvement. Similarly, earnings per share hit £0.30, reversing previous losses. Consequently, the business model proves increasingly sustainable. Therefore, cash generation capabilities strengthen continuously.

Gross profit margins expanded to 22.3%, indicating operational efficiency gains. Additionally, cost control measures deliver measurable results. Moreover, the company maintains healthy balance sheet metrics. Furthermore, debt reduction efforts show consistent progress.

Aerospace Recovery Drives Long-Term Growth

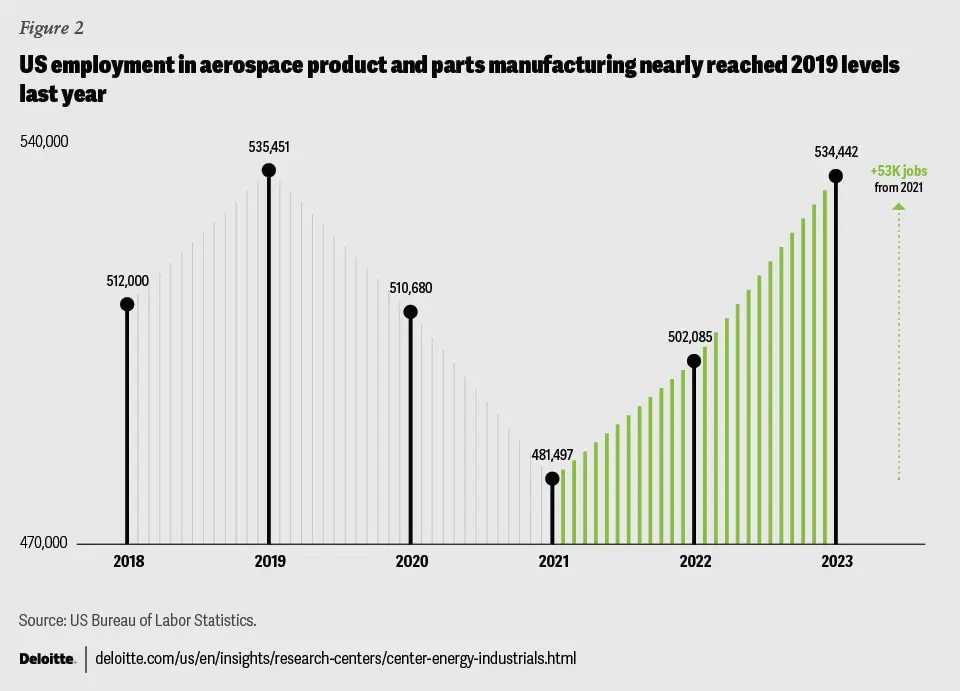

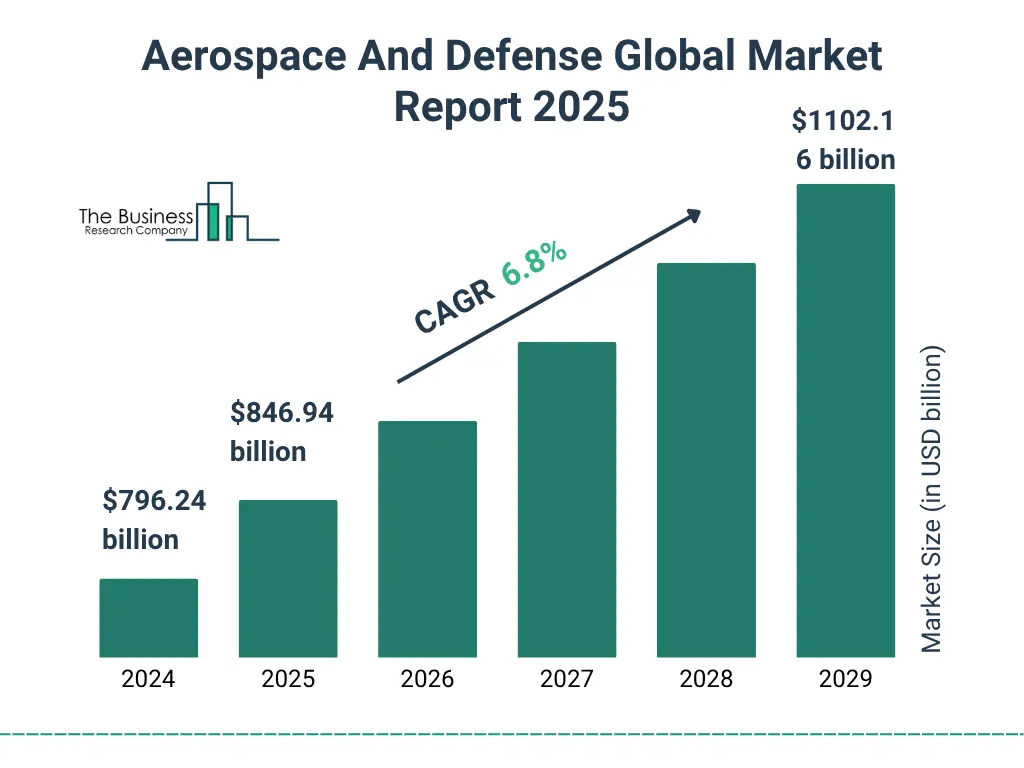

The global aerospace market continues experiencing robust expansion. Moreover, post-pandemic recovery accelerates across commercial aviation. Additionally, defense spending remains elevated worldwide. Furthermore, emerging markets drive substantial demand growth.

Aircraft manufacturers report strong order backlogs currently. Similarly, maintenance requirements increase as fleets age. Consequently, service revenues provide stable income streams. Therefore, multiple revenue sources create diversification benefits.

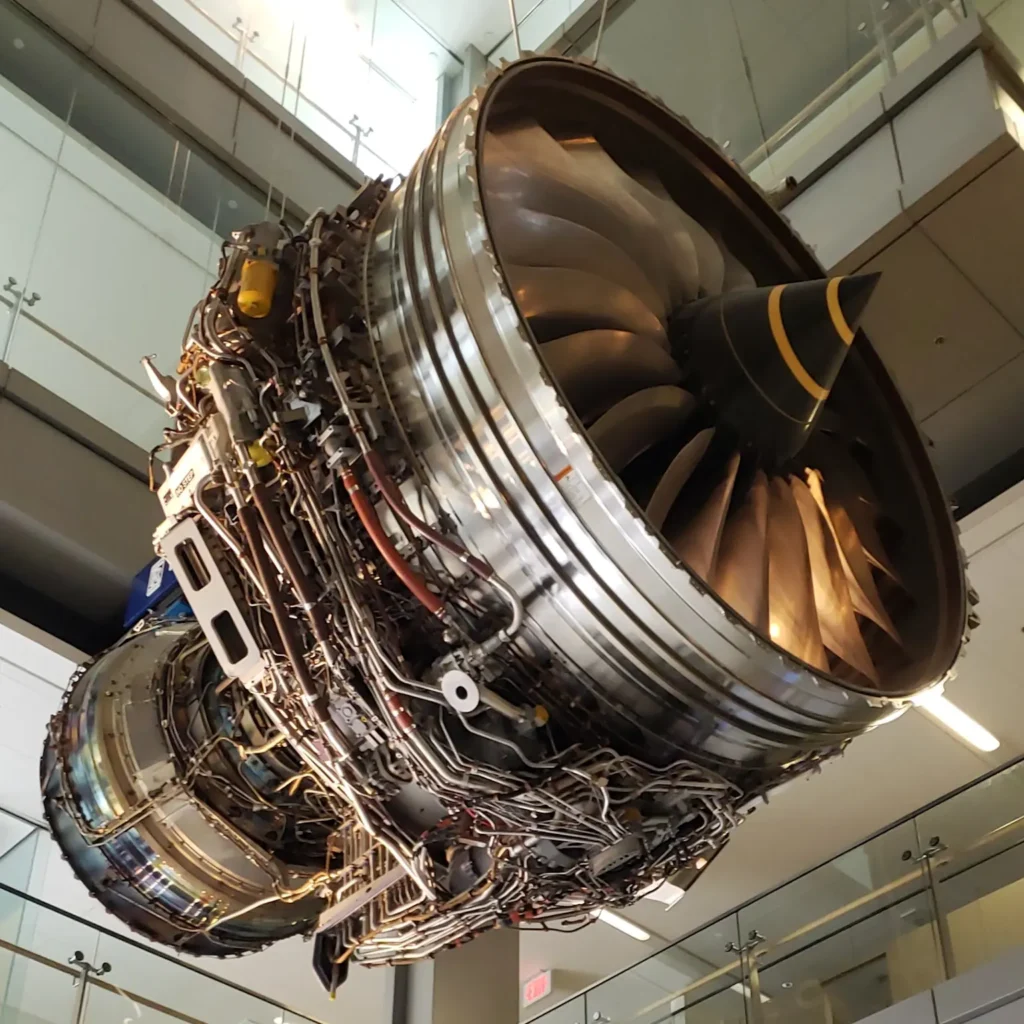

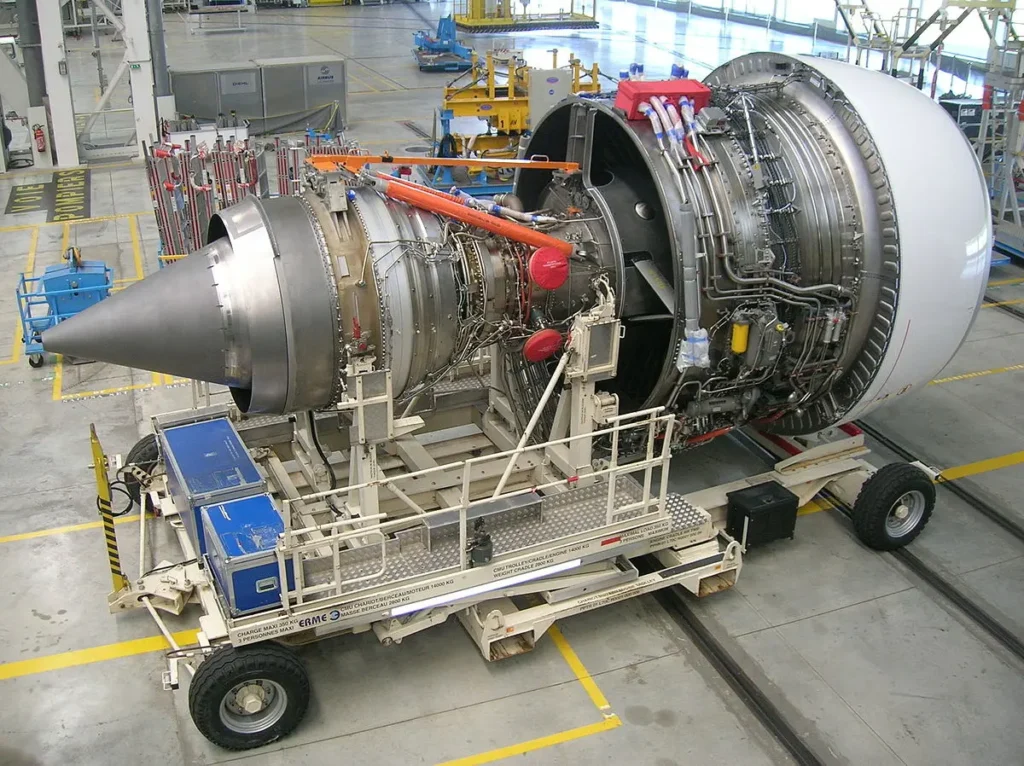

Engine technology advancement creates competitive advantages. Additionally, fuel efficiency improvements attract airline customers. Moreover, environmental regulations favor newer technologies. Furthermore, replacement cycles support sustained demand.

Nuclear Energy Presents Massive Opportunity

Small modular reactors represent potentially transformational growth opportunities. Moreover, the company positions itself as a nuclear technology leader. Additionally, estimated market potential exceeds one trillion dollars. Furthermore, government support accelerates development timelines.

AI data centers require massive power generation capabilities. Similarly, clean energy transitions favor nuclear solutions. Consequently, demand projections show exponential growth potential. Therefore, first-mover advantages become increasingly valuable.

The company develops multiple nuclear projects across different regions. Additionally, partnerships with governments provide development support. Moreover, regulatory approvals progress steadily. Furthermore, commercial viability improves continuously.

Chart Analysis Reveals Bullish Patterns

Technical analysis shows strong momentum continuation patterns. Moreover, the stock broke through key resistance levels. Additionally, moving averages provide dynamic support. Furthermore, relative strength indicators remain positive.

Volume analysis confirms institutional participation increases. Similarly, accumulation patterns suggest long-term positioning. Consequently, technical setup favors continued upward movement. Therefore, entry timing becomes less critical.

Price targets from analysts average around £10.21 currently. Additionally, estimates range from £2.40 to £14.40. Moreover, consensus ratings remain moderately bullish. Furthermore, upgrades continue following strong results.

Key Investment Risks Require Consideration

Aerospace investments carry inherent cyclical volatility risks. Moreover, economic downturns affect commercial aviation significantly. Additionally, regulatory changes impact operations substantially. Furthermore, competition remains intense across segments.

Development costs for new technologies require substantial capital investment. Similarly, certification processes create lengthy development timelines. Consequently, returns on investment take years to materialize. Therefore, patience becomes essential for success.

Geopolitical factors affect international operations regularly. Additionally, supply chain disruptions create operational challenges. Moreover, skilled labor shortages impact production capabilities. Furthermore, commodity price fluctuations affect margins.

Multiple Growth Catalysts

Several factors support positive long-term investment prospects. Moreover, operational improvements continue driving efficiency gains. Additionally, new technologies create competitive advantages. Furthermore, market positioning strengthens continuously.

The aerospace recovery cycle supports sustained revenue growth. Similarly, defense spending provides stable income streams. Consequently, diversified revenue sources reduce business risks. Therefore, total returns could exceed market averages.

Nuclear energy development offers exponential growth potential. Additionally, partnership opportunities expand globally. Moreover, government support accelerates project timelines. Furthermore, first-mover advantages create substantial value.

Conclusion: Compelling Turnaround Investment Case

This aerospace leader offers compelling value for patient investors. However, thorough research and appropriate position sizing remain essential. Additionally, understanding business fundamentals helps make informed decisions. Therefore, consider this stock for long-term wealth creation.

The combination of aerospace recovery, nuclear opportunities, and operational improvements creates multiple growth themes. Moreover, technical patterns support continued strength. Nevertheless, investors must prepare for inherent volatility.

You Might also find this post insightful – https://bosslevelfinance.com/rivian-s-edge-trucks-tech-tenacity

Important Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. We do not encourage users to buy, sell, or hold any stocks. Stock markets are subject to risks and can change rapidly. Please conduct your own due diligence and consult with financial professionals before making investment decisions.

Sources:

- The Motley Fool UK: Latest forecast for Rolls-Royce shares

- TradingView: RR Forecast Price Target Prediction for 2026

- MarketBeat: Rolls-Royce Holdings Stock Forecast Price Target 2025

- Yahoo Finance UK: Latest forecast for Rolls-Royce shares

- Yahoo Finance UK: Can powering AI push Rolls-Royce shares to 2,046p

- Investing.com UK: Rolls-Royce Holdings Share Price Forecast

- Quiver Quantitative: Rolls-Royce Holdings analyst price target upgrades

- Investors Chronicle: Rolls-Royce Holdings PLC forecasts data

- Dhan: Aerospace Defence Stocks sector analysis

- Screener: Aerospace Defense Companies financial data

- https://www.fool.co.uk/2025/08/11/heres-the-latest-forecast-for-rolls-royce-shares/

- https://in.tradingview.com/markets/stocks-usa/sectorandindustry-industry/aerospace-defense/

- https://www.tradingview.com/symbols/LSE-RR./forecast/

- https://www.marketbeat.com/stocks/LON/RR/forecast/

- https://www.screener.in/market/IN07/IN0702/IN070201/

- https://uk.finance.yahoo.com/news/latest-forecast-rolls-royce-shares-120308845.html

- https://uk.finance.yahoo.com/news/powering-ai-push-rolls-royce-083455882.html

- https://dhan.co/stocks/sector/aerospace-defence-stocks/

- https://uk.investing.com/equities/rolls-royce-consensus-estimates

- https://www.quiverquant.com/news/Rolls-Royce+Holdings+Stock+(RR)+Opinions+on+Analyst+Price+Target+Upgrades

- https://markets.investorschronicle.co.uk/data/equities/tearsheet/forecasts?s=RR.%3ALSE

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/c892d4d59e491d9a6f061f9966a380a5/0eb211a5-dc49-4b30-8366-ca36bfc272fa/88f6f178.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/c892d4d59e491d9a6f061f9966a380a5/7cb96054-b53e-4d81-ad3e-47230efa42de/9369e43c.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/c892d4d59e491d9a6f061f9966a380a5/f4614140-379b-4076-bf83-9e40d0051eab/f771dfe4.csv