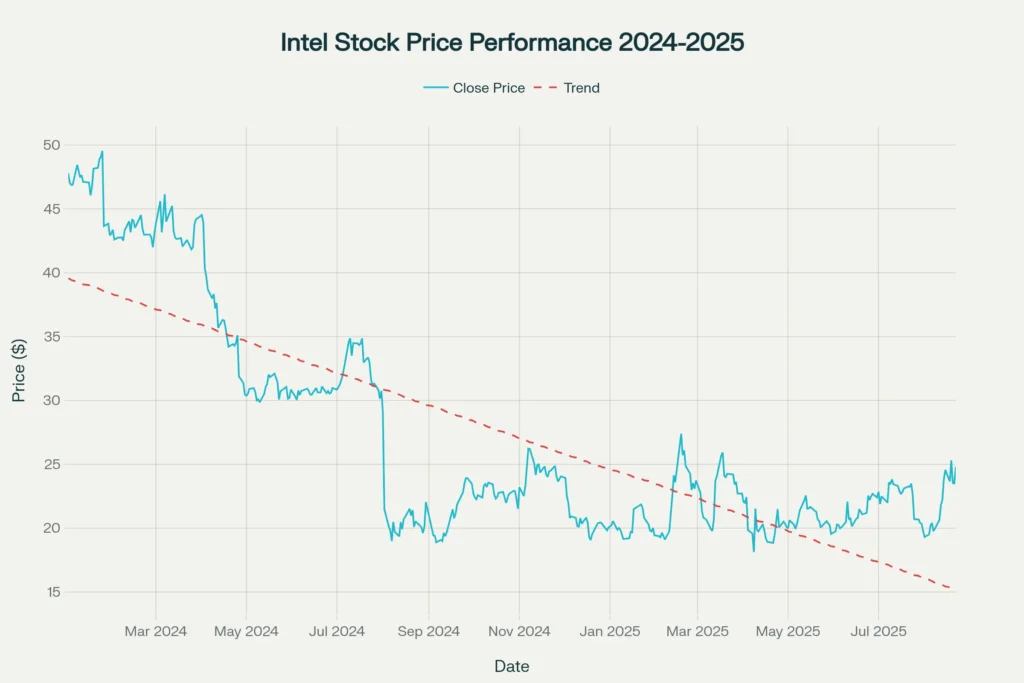

Intel Corporation has captured attention as one of 2024’s most dramatic stock stories. Furthermore, this semiconductor giant plunged nearly 50% from its 52-week high of $49.55 to current levels around $24.80. However, beneath the surface turmoil lies a fascinating transformation narrative. Moreover, the company’s foundry business model shift and artificial intelligence chip market positioning present intriguing investment considerations for value-focused portfolios.

The Brutal Numbers Behind Intel’s Stock Decline

Intel’s financial performance tells a sobering tale. Additionally, the company reported a staggering $18.8 billion net loss in 2024 on revenues of $53.1 billion. Meanwhile, the stock’s 48% year-to-date decline reflects investor concerns about competitive pressures and strategic execution.

Nevertheless, daily trading volume averaging 76 million shares indicates sustained institutional interest. Furthermore, the stock’s 3.59% daily volatility creates opportunities for nimble traders. Most importantly, the negative P/E ratio of -5.26 reflects temporary losses rather than fundamental business destruction.

Understanding Intel’s Foundry Business Model Revolution

Intel’s most significant strategic shift involves separating its foundry operations from product design. Consequently, this transformation creates transparency between manufacturing and chip development divisions. Additionally, the foundry business generated $17.5 billion in revenue during 2024, despite declining 7% year-over-year.

Moreover, this restructuring positions Intel to compete directly with Taiwan Semiconductor Manufacturing Company (TSMC). However, the foundry division recorded a $5.8 billion operating loss in the most recent quarter. Therefore, achieving profitability remains the critical challenge ahead.

Semiconductor Value Investing Opportunities Emerge

The dramatic valuation compression creates potential opportunities for contrarian investors. Furthermore, Intel’s market capitalization of approximately $109.8 billion represents significant discount to historical valuations. Additionally, the company’s $100 billion capital asset base provides substantial tangible value.

However, the dividend suspension starting in Q4 2024 removes income-focused appeal. Meanwhile, management projects foundry breakeven performance by 2027. Therefore, patience becomes essential for any recovery thesis.

Artificial Intelligence Chip Market Share Battles Intensify

Intel faces fierce competition in the lucrative AI accelerator market. Meanwhile, NVIDIA dominates with approximately 80% market share in AI chips. Additionally, Advanced Micro Devices (AMD) gained ground with its MI325X processors targeting data center applications.

However, Intel’s Gaudi processors offer cost-effective alternatives for enterprises. Furthermore, the company’s workstation AI GPUs (Arc Pro B50 and B60) target different market segments. Therefore, success depends on execution rather than just technology superiority.

Technology Turnaround Investment Strategy Considerations

Intel’s 18A process node development represents a crucial inflection point. Moreover, successful execution could restore manufacturing leadership by 2025. Additionally, the company’s five-nodes-in-four-years roadmap demonstrates aggressive innovation commitment.

Nevertheless, capital expenditure requirements remain substantial. Furthermore, competitive pressure from AMD’s Ryzen processors continues in traditional CPU markets. Therefore, investors must weigh potential rewards against execution risks.

Financial Recovery Timeline and Margin Expansion Goals

Management targets 60% gross margins and 40% operating margins by 2030. Additionally, the foundry business aims for breakeven performance by 2027. Moreover, cost reduction initiatives include over 15% workforce reductions and $10 billion spending cuts.

However, achieving these ambitious targets requires flawless execution. Furthermore, macroeconomic headwinds and inventory corrections create near-term challenges. Therefore, the recovery timeline extends beyond typical investment horizons.

Beaten Down Tech Stocks Potential Assessment

Intel’s current valuation reflects maximum pessimism about future prospects. Additionally, the stock trades below tangible book value, suggesting limited downside protection. Moreover, any positive catalysts could generate substantial upside momentum.

However, fundamental improvements require time and capital investment. Furthermore, competitive dynamics in semiconductors remain intensely challenging. Therefore, position sizing becomes critical for risk management.

Investment Thesis Summary and Risk Disclosure

Intel’s transformation from integrated device manufacturer to foundry services provider represents a bold strategic pivot. Additionally, the company’s substantial asset base and technology capabilities provide competitive advantages. Moreover, current valuations reflect significant pessimism, creating potential value opportunities.

However, execution risks remain substantial. Furthermore, competitive pressures continue across all business segments. Therefore, thorough due diligence becomes essential before making investment decisions.

You Might also find this post insightful – https://bosslevelfinance.com/why-us-healthcare-looks-like-a-value-goldmine

Important Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Moreover, stock markets are subject to significant volatility and risk. Additionally, past performance does not guarantee future results. Therefore, conduct your own due diligence and consult qualified financial advisors before making investment decisions. Furthermore, never invest more than you can afford to lose.

Sources:

- Nasdaq.com – Intel stock performance analysis

- Intel Corporation investor relations and financial reports

- CNBC semiconductor industry coverage

- Yahoo Finance Intel financial data

- Forbes AI chip market analysis

- TechTarget Intel timeline and competitive analysis

- Futurum Group Intel quarterly analysis

- Various financial news sources and market data providers

- https://www.nasdaq.com/articles/why-intel-stock-fell-60-2024

- https://www.intc.com/news-events/press-releases/detail/1687/intel-outlines-financial-framework-for-foundry-business

- https://varindia.com/news/chip-wars-intel-amd-qualcomm-vs-nvidia-ai-powered-amd

- https://www.nasdaq.com/articles/intel-stock-tailspin-what-lies-behind-downfall

- https://futurumgroup.com/insights/intel-q1-2024-results-new-reporting-structure-with-top-bottom-beat/

- https://www.cnbc.com/2024/10/10/amd-launches-mi325x-ai-chip-to-rival-nvidias-blackwell-.html

- https://www.ebc.com/forex/why-is-intel-stock-so-cheap-key-reasons-explained

- https://www.crn.com/news/components-peripherals/2025/intel-expects-revenue-to-fall-due-to-competition-economic-uncertainty

- https://research.aimultiple.com/ai-chip-makers/

- https://www.techtarget.com/whatis/feature/Intels-rise-and-fall-A-timeline-of-what-went-wrong

- https://www.eenewseurope.com/en/foundry-unit-haunts-tepid-intel-fourth-quarter-results/

- https://finance.yahoo.com/news/intel-debuts-ai-gpus-for-workstation-system-as-it-works-to-gain-ground-on-nvidia-amd-103026410.html

- https://www.intc.com/news-events/press-releases/detail/1704/intel-reports-second-quarter-2024-financial-results

- https://www.forbes.com/sites/emilsayegh/2024/12/11/the-ai-chip-race-who-can-compete-with-nvidia/

- https://carboncredits.com/intel-stock-surges-9-8-on-2b-softbank-deal-can-its-net-zero-push-power-the-future-of-chips/

- https://patentpc.com/blog/the-ai-chip-market-explosion-key-stats-on-nvidia-amd-and-intels-ai-dominance

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/5b9f5211446ab523c0b1069ed0631801/9eb28d29-949c-4b63-b92d-668eff49d0b4/fb6986bf.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/5b9f5211446ab523c0b1069ed0631801/9eb28d29-949c-4b63-b92d-668eff49d0b4/f48c7550.csv

- https://ppl-ai-code-interpreter-files.s3.amazonaws.com/web/direct-files/5b9f5211446ab523c0b1069ed0631801/3a47d780-795f-4cdc-a80b-5cfb68ad4502/8c5c3c68.csv