The stock market can be overwhelming. Many investors wonder if they’ve missed the boat on big tech names like Apple, Nvdia, Amazon, etc. But here’s something interesting: some of the most successful wealth builders focus on companies with multiple revenue streams and long-term growth potential.

Today, we’ll dive deep into one such company that continues to dominate multiple industries. This analysis explores why Amazon might deserve a spot in your investment portfolio.

Amazon’s Market Position

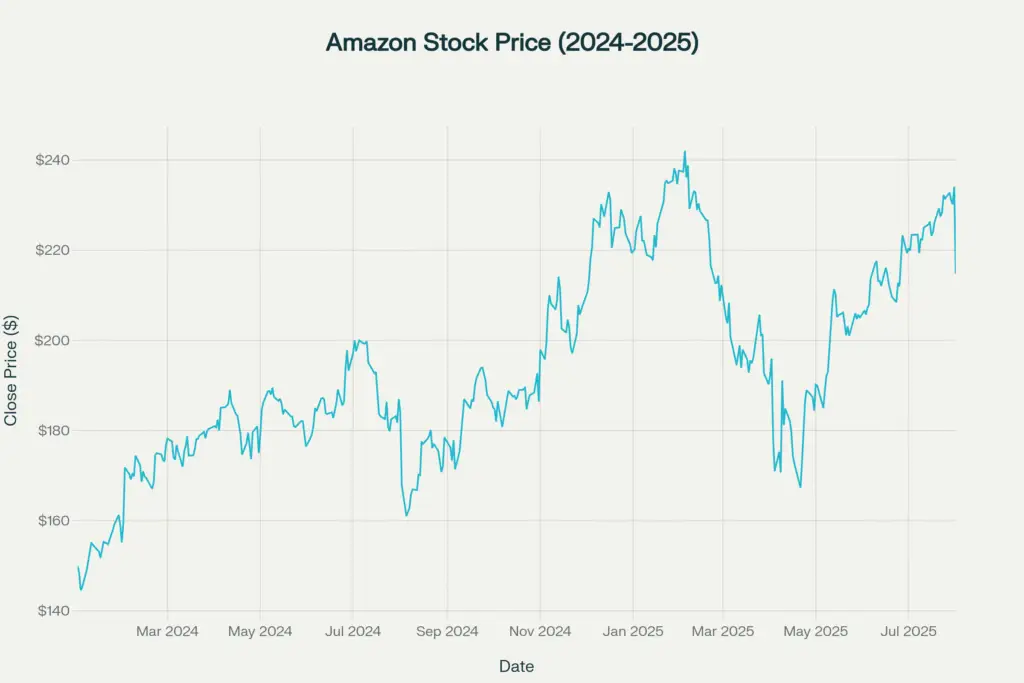

The e-commerce giant we’re analyzing today trades at $214.75 per share. The stock recently experienced an 8.27% decline following quarterly earnings. However, this pullback might present an opportunity for long-term investors.

Let’s look at some key numbers:

- Market Cap: $2.28 trillion

- P/E Ratio: 32.79

- 52-week range: $151.61 – $242.52

- Current trading: Near the lower end of the yearly range

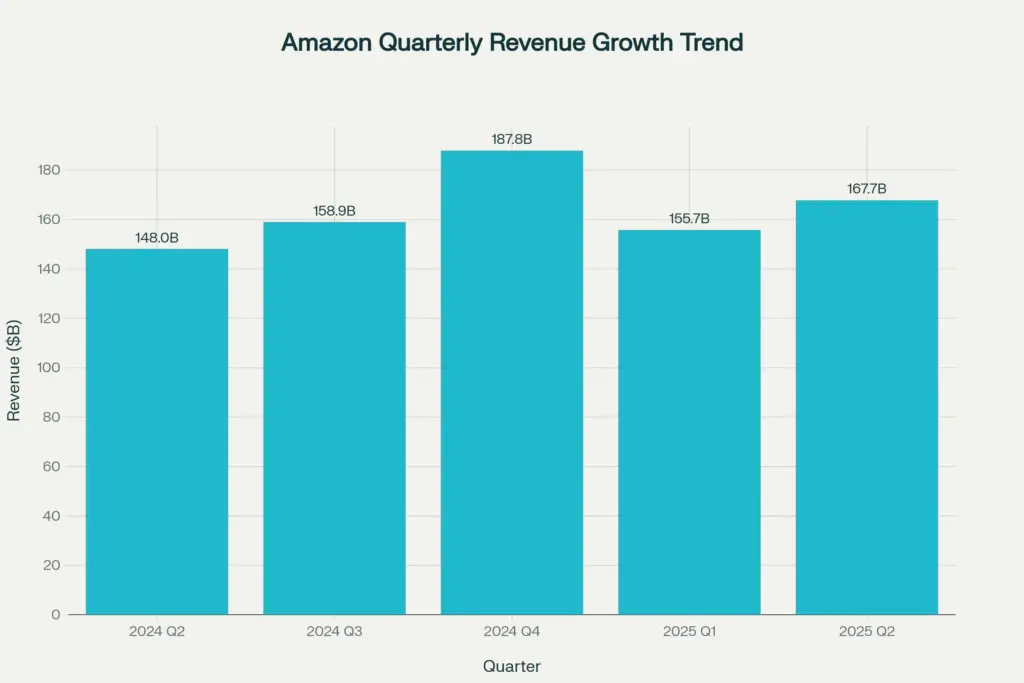

The company beat analyst expectations in the most recent quarter. Revenue came in at $167.7 billion, which was above the expected $162 billion. Earnings per share hit $1.68, significantly higher than the predicted $1.33.

Amazon’s Business Segments Driving Growth

Cloud Computing Dominance

Amazon Web Services (AWS) remains the crown jewel. This segment generates the highest profit margins. In the latest quarter, AWS revenue grew 17.5% to $30.9 billion. Operating income reached $10.2 billion.

The company leads the cloud market globally. While competitors like Microsoft and Google are growing faster, AWS still holds the largest market share. The segment faces capacity constraints due to high demand for AI services.

E-Commerce Evolution

The core retail business continues to evolve. Online store sales grew 11% in the second quarter. Third-party seller services also expanded by 11%.

The company has been improving operational efficiency. This leads to better profit margins across the retail segments. North American operations showed strong performance with healthy margins.

Financial Health Check

The financial metrics tell a compelling story:

| Quarter | Revenue ($B) | Net Income ($B) | EPS ($) | Net Margin (%) |

|---|---|---|---|---|

| Q2 2025 | 167.70 | 18.16 | 1.71 | 10.83 |

| Q1 2025 | 155.67 | 17.13 | 1.62 | 11.00 |

| Q4 2024 | 187.79 | 20.00 | 1.90 | 10.65 |

| Q3 2024 | 158.88 | 15.33 | 1.46 | 9.65 |

| Q2 2024 | 147.98 | 13.48 | 1.29 | 9.11 |

The numbers show consistent revenue growth. Net income has improved significantly year-over-year. The company’s ability to generate cash flow remains strong.

Why Consider Building a Position Now?

Valuation Opportunity

The recent stock decline creates a potential entry point. The forward P/E ratio of around 34 times 2025 estimates appears reasonable for a company of this quality.

Historically, the stock has performed well during heavy investment periods. The company is currently investing heavily in AI infrastructure and data centers.

Multiple Revenue Streams

This isn’t just an e-commerce company anymore. The business includes:

- Cloud computing services

- Digital advertising

- Subscription services

- Logistics and fulfillment

- Entertainment content

- Smart devices and voice technology

This diversification reduces risk and creates multiple growth opportunities.

Long-term Secular Trends

Several trends support long-term growth:

- Digital transformation acceleration

- Cloud migration continues globally

- E-commerce penetration still growing

- AI adoption creating new opportunities

- Advertising dollars shifting to digital platforms

Investment Approach for Building Wealth

Dollar-Cost Averaging Strategy

Instead of trying to time the market, consider systematic investment. This approach works well for quality companies with long-term potential.

For example:

- Monthly investments of $500-1000

- Buying during market dips

- Reinvesting dividends (when available)

- Holding for 5-10 year timeframes

Taking Advantage of Volatility

The stock can be volatile due to its size and market attention. Smart investors use this volatility as an opportunity:

- Build larger positions during significant declines

- Add gradually during normal market conditions

- Stay focused on business fundamentals rather than short-term price movements

Risks to Consider

Competition Intensifies

Cloud computing faces intense competition. Microsoft Azure and Google Cloud are growing faster in some quarters. The company must continue innovating to maintain leadership.

Regulatory Concerns

Large tech companies face increasing regulatory scrutiny. Antitrust concerns could impact future growth or force business changes.

Economic Sensitivity

Consumer spending affects the retail business. Economic downturns could impact growth rates across segments.

High Capital Requirements

The business requires massive ongoing investments. Data centers, fulfillment centers, and technology development need continuous funding.

Technical Analysis Insights

Looking at the price chart, the stock shows:

- Strong support levels around $150-160

- Recent high near $242 in early 2025

- Current trading in the middle of the range

- Volume spikes during earnings announcements

The technical picture suggests the stock could find support at current levels. However, technical analysis should be combined with fundamental research.

Why This Could Be Your Second Chance

Many investors regret not buying quality companies earlier. This stock has created enormous wealth for long-term holders. The recent pullback might offer a fresh opportunity.

Consider these factors:

- The company continues growing revenue and profits

- Market leadership across multiple segments

- Strong balance sheet and cash generation

- Proven ability to invest in new growth areas

- Management team with track record of innovation

The key is thinking like a business owner rather than a trader. Focus on the company’s ability to grow earnings over years, not quarterly price movements.

Building Your Investment Plan

For New Investors

Start small but consistent:

- Begin with amounts you can afford to lose

- Study the business thoroughly

- Use dollar-cost averaging

- Plan to hold for at least 5 years

For Experienced Investors

Consider position sizing based on:

- Overall portfolio allocation to tech stocks

- Risk tolerance and time horizon

- Current valuation relative to historical levels

- Other holdings and diversification needs

The Bottom Line

This analysis suggests the company remains a strong long-term investment candidate. The recent decline might provide an attractive entry point for patient investors.

The business continues generating strong cash flows. Multiple growth drivers remain intact. The competitive position stays solid across key segments.

However, remember that all investments carry risks. Stock prices can decline significantly during market downturns. Only invest money you can afford to keep invested for years.

The most successful investors often build wealth by owning quality companies for long periods. They use market volatility as an opportunity rather than a reason to panic.

This approach requires patience and discipline. But for those willing to think long-term, quality companies with multiple growth drivers often reward patient shareholders.

You Might also find this post insightful – https://bosslevelfinance.com/costco-s-membership-model-the-secret-to-lasting-growth

Important Disclaimer: This is purely educational analysis. We do not encourage users to buy, sell, or hold any stocks. Markets are subject to risks and can change rapidly. Always do your own research and consult with financial advisors before making investment decisions.

Sources:

- https://www.nasdaq.com/articles/amazon-stock-crushed-market-2024-can-it-repeat-2025

- https://www.mexem.com/blog/amazons-financial-performance-a-comprehensive-analysis

- https://finance.yahoo.com/news/amazon-beats-on-q1-earnings-but-light-q2-guidance-weighs-on-stock-200554189.html

- https://wise.com/in/stock/amzn

- https://www.cnbc.com/2025/08/01/amazon-earnings-ai-aws-tariffs.html

- https://www.tipranks.com/stocks/amzn/financials

- https://www.businessinsider.com/amazon-q2-earnings-updates-aws-prime-day-amzn-stock-price-2025-7

- https://www.cnbc.com/quotes/AMZN

- https://stockanalysis.com/stocks/amzn/

- https://ir.aboutamazon.com/news-release/news-release-details/2025/Amazon-com-Announces-Fourth-Quarter-Results/default.aspx

- https://www.wsj.com/tech/amazon-earnings-q2-2025-amzn-stock-cb60512a

- https://www.google.com/finance/quote/AMZN:NASDAQ?hl=en

- https://in.tradingview.com/symbols/NASDAQ-AMZN/

- https://finance.yahoo.com/quote/AMZN/financials/

- https://www.cnbc.com/2025/07/31/amazon-amzn-q2-earnings-report-2025.html

- https://www.benzinga.com/markets/earnings/25/08/46820906/amazon-founder-jeff-bezos-loses-17-billion-following-companys-mixed-q2-earnings

- https://www.tipranks.com/stocks/amzn/earnings

- https://www.nasdaq.com/articles/dip-amazon-stock-buying-opportunity-or-should-investors-run-hills

- https://www.nasdaq.com/articles/amazon-stock-crushed-market-2024-can-it-repeat-2025

- https://www.mexem.com/blog/amazons-financial-performance-a-comprehensive-analysis

- https://finance.yahoo.com/news/amazon-beats-on-q1-earnings-but-light-q2-guidance-weighs-on-stock-200554189.html

- https://wise.com/in/stock/amzn

- https://www.cnbc.com/2025/08/01/amazon-earnings-ai-aws-tariffs.html

- https://www.tipranks.com/stocks/amzn/financials

- https://www.businessinsider.com/amazon-q2-earnings-updates-aws-prime-day-amzn-stock-price-2025-7

- https://www.cnbc.com/quotes/AMZN

- https://stockanalysis.com/stocks/amzn/

- https://ir.aboutamazon.com/news-release/news-release-details/2025/Amazon-com-Announces-Fourth-Quarter-Results/default.aspx

- https://www.wsj.com/tech/amazon-earnings-q2-2025-amzn-stock-cb60512a

- https://www.google.com/finance/quote/AMZN:NASDAQ?hl=en

- https://in.tradingview.com/symbols/NASDAQ-AMZN/

- https://finance.yahoo.com/quote/AMZN/financials/

- https://www.cnbc.com/2025/07/31/amazon-amzn-q2-earnings-report-2025.html

- https://www.benzinga.com/markets/earnings/25/08/46820906/amazon-founder-jeff-bezos-loses-17-billion-following-companys-mixed-q2-earnings

- https://finance.yahoo.com/quote/AMZN/history/

- https://in.investing.com/equities/amazon-com-inc-financial-summary

- https://www.tipranks.com/stocks/amzn/earnings

- https://www.nasdaq.com/articles/dip-amazon-stock-buying-opportunity-or-should-investors-run-hills