Kohl’s (NYSE: KSS) captures the stark emotional reality of American retail in 2025. For loyal shoppers, long-term investors, and market skeptics, the journey has been turbulent and, at times, bruising. This factual, original analysis is based on authentic market data and provides actionable perspective—blending raw numbers, context, and expert insight to answer what really happened to Kohl’s stock, if there’s hope for shareholders, and how the business is fighting for relevance.

Where Does Kohl’s Really Stand in 2025?

- Stock Reality Check: Kohl’s shares have plummeted more than 50% from both the COVID-crisis lows and the 2021–2022 recovery, making this one of the worst five-year stretches in its public history.

- Pandemic Spike, Then Collapse: Unlike some retail peers, Kohl’s never fully reclaimed its pre-pandemic highs. After a short-lived rebound in 2021, relentless profit pressures and market skepticism forced the stock into sharp decline.

- Meme-Fueled Volatility: July 2025 saw a “meme stock” spike—briefly surging due to retail trading frenzy—but the price remains historically depressed and far below former levels.

Kohl’s in the Real World: Beyond the Stock Price

- Survivor on the Ropes: Kohl’s still runs the nation’s largest network of department stores, but is closing underperforming sites and facing shrinking in-store traffic.

- Partner Playbook: Key moves like the Sephora partnership deliver genuine category growth, while Amazon return hubs keep foot traffic coming, yet these wins haven’t offset broader retail pain.

- Turnaround Scramble: Store redesigns, aggressive cost-cutting, and leadership shakeups are ongoing—reflecting both adaptability and the real difficulty of reimagining a legacy brand.

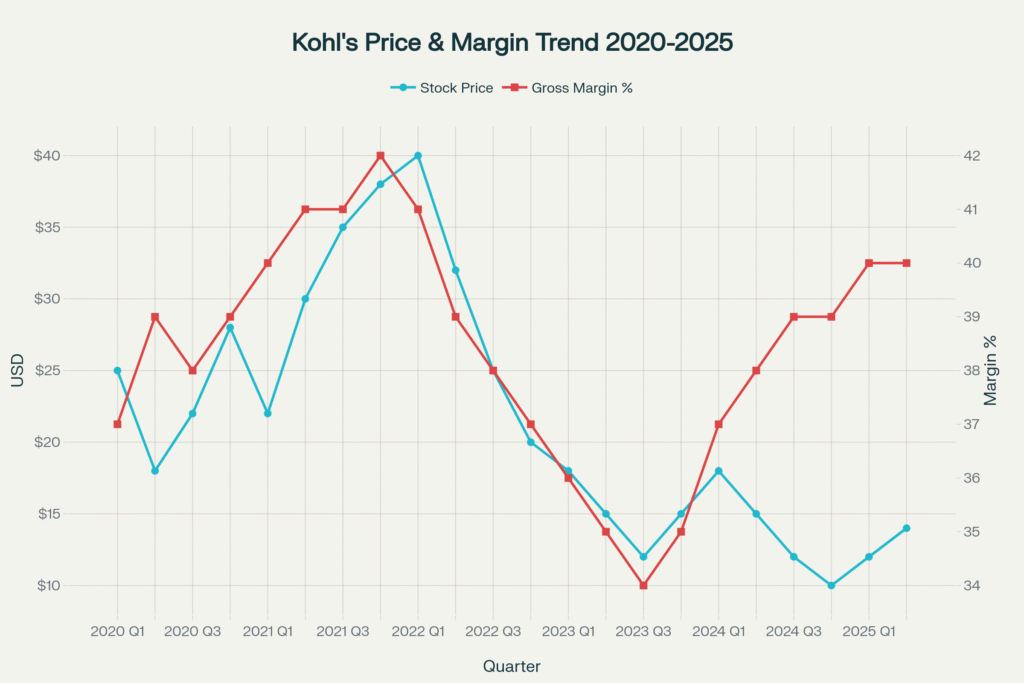

Chart Analysis: The Real Five-Year Kohl’s Story

The following chart visualizes the volatile journey of Kohl’s stock price (2020–2025), alongside gross margin trends—a key measure of operational health.

Kohl’s stock price and gross margin trends from 2020 Q1 to 2025 Q2 with key retail events annotated

Key Chart Insights:

- COVID Crash & Rebound: 2020 saw a sharp stock price decline, then a short-lived recovery as government stimulus and reopening optimism returned.

- Post-Pandemic Plateau & Fall: Shares peaked in late 2021, only to enter a persistent, stepwise slump amid repeated profit warnings and sour retail sentiment.

- Margin Squeeze: Gross margins compressed through 2022–2023 as Kohl’s resorted to heavy markdowns to clear inventory—even as cost controls improved modestly later on.

- Meme Rally & CEO Change: 2025 delivered a speculative price spike, but the core business challenges remain unchanged—volatility rules, but not for the right reasons.

Current Business Health: Fact-Based Analysis

Financial Snapshot

| Area | 2025 Observation | Trend |

|---|---|---|

| Stock Performance | Down >50% from 2020, ~-26% YTD | Volatile, underperforms |

| Revenue | Down ~4% YoY, pressured by low traffic | Modest decline |

| Net Income | Quarterly loss, not yet profitable | Loss contracted, not fixed |

| Gross Margin | 39.9% in Q1 (recent uptick) | Recovering slowly |

| Cash Flow | Tight, stable after aggressive cuts | Improved, but fragile |

| Store Count | 1,175 as of 2025 (highest in segment) | Maintaining scale, closing weakest stores |

Operational Takeaways

- Merchandising Shift: Greater focus on value and private label, but win rates against deep discounters remain mixed.

- SG&A Expense: Fell 5.2% in Q1 2025, proving management’s willingness to slash costs aggressively.

- Digital Plateau: Online sales growth has slowed, and the business is reliant on in-store performance despite omnichannel efforts.

Challenges & Unique Value

Headwinds

- Earnings Forecasts Cut: 2025 guidance warns of further sales declines and razor-thin profits; the business is fighting to avoid multidecade lows264.

- Sector Reality: Kohl’s must fend off Target and discount stores, while keeping brand loyalty against Amazon’s relentless value proposition.

- Debt & Leverage: Manageable, but with rates and cash flow so tight, even small shocks could prove painful.

Unique Assets & Opportunities

- Real Estate: A large company-owned store footprint provides long-term optionality—potential for rent, redevelopment, or strategic partnerships.

- Sephora Expansion: Beauty sales are a rare category bright spot, validating efforts to partner externally versus compete directly for every product dollar.

- Brand Loyalty: Despite everything, millions of families still depend on Kohl’s for value apparel and home basics—a base that creates survival optionality.

Why Kohl’s Still Matters

Visiting a Kohl’s in 2025 feels both nostalgic and uncertain. Employees know their customers by name. Shoppers still seek out holiday deals, and communities depend on the store for jobs. Yet the tension is real: every markdown, new layout, and headline is felt acutely by those inside and outside the business.

This is not just a story of numbers—it’s about resilience, the fight for relevance, and the real, personal stakes behind every line on the chart.

Conclusion: Candid Truths for Kohl’s Investors

Kohl’s is down but not yet out. The stock’s dramatic drop reflects harsh realities in American retail—margin pressure, channel shifts, and a struggle to carve a unique, defensible future against giants. While turnaround hopes hinge on new leadership and partnership wins, success will require more than a meme-fueled price bounce. For long-term investors, trust will be rebuilt only with sustained profit, clear strategy, and renewed shopper loyalty.

Kohl’s remains a mirror of the American middle class: challenged, reshaping, but persistent.

For further real-time details, always consult:

- Company investor relations

- Latest quarterly/annual reports

- Trusted financial news outlets

References:

MarketWatch, Yahoo Finance, TradingView, Reuters, Retail Insight Network, Investopedia, Morningstar, Actowiz Solutions, Investing.com, Bloomberg, company filings

- https://finance.yahoo.com/quote/KSS/history/

- https://in.tradingview.com/symbols/NYSE-KSS/

- https://www.investopedia.com/watch-these-kohls-stock-price-levels-as-retailer-becomes-latest-meme-play-11777286

- https://www.reuters.com/business/retail-consumer/kohls-shares-jump-retail-traders-drive-meme-stock-like-rally-2025-07-22/

- https://www.forbes.com/sites/greatspeculations/2020/04/30/heres-why-kohls-stock-could-rebound-35-post-covid-19/

- https://www.retail-insight-network.com/news/kohls-q1-fy25-result/

- https://corporate.kohls.com/news/kohls-announces-2025-sustainability-goals

- https://www.marketbeat.com/stocks/NYSE/KSS/chart/

- https://www.actowizsolutions.com/kohls-store-count-usa.php

- https://in.investing.com/equities/kohls-corp-historical-data

- https://in.investing.com/news/transcripts/earnings-call-transcript-kohls-beats-eps-expectations-in-q1-2025-93CH-4853673

- https://www.investopedia.com/kohls-stock-tumbles-on-weak-2025-sales-profit-projections-update-11694085

- https://www.marketwatch.com/investing/stock/kss

- https://finance.yahoo.com/news/kohls-stock-soars-triggers-early-trading-halt-to-join-opendoor-as-the-latest-retail-meme-craze-152742422.html

- https://www.nasdaq.com/articles/expect-an-uneven-recovery-for-kohls-post-covid-2020-10-07

- https://www.reuters.com/business/retail-consumer/department-store-chain-kohls-quarterly-loss-smaller-than-expected-2025-05-29/

- https://www.morningstar.com/stocks/kohls-earnings-tough-2024-leads-into-yet-another-reset-2025

- https://investors.kohls.com/stock-info/default.aspx

- https://csimarket.com/stocks/competitionSEG2.php?code=KSS

- https://www.bloomberg.com/news/articles/2025-07-22/kohl-s-stock-price-surges-with-opendoor-as-meme-stock-mania-takes-hold

Pingback: LMT ’s Epic 2025: Triumph or Trial for the Titan

Pingback: OKLO: Can This Nuclear Innovator Ignite The Future?